Time Magazine 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

Revolving Bank Credit Facilities

On September 27, 2011, Time Warner amended its $5.0 billion senior unsecured credit facilities, which had

consisted of a $2.5 billion three-year revolving credit facility and a $2.5 billion five-year revolving credit facility.

The amendment changed the $2.5 billion three-year revolving credit facility to a $2.5 billion four-year revolving

credit facility with a maturity date of September 27, 2015 (the “Four Year Revolving Credit Facility”) and

extended the maturity date of the $2.5 billion five-year revolving credit facility from January 19, 2016 to

September 27, 2016 (the “Five Year Revolving Credit Facility” and, together with the Four Year Revolving

Credit Facility, the “Revolving Credit Facilities”). The amendment also reduced interest rates and facility fees

and eliminated the reference to the percentage of commitments used under the Revolving Credit Facilities for the

purpose of calculating the interest rate on borrowings under the Revolving Credit Facilities. See “Financial

Condition and Liquidity — Outstanding Debt and Other Financing Arrangements” for more information.

Common Stock Repurchase Program

On January 31, 2012, the Company’s Board of Directors authorized a new $4.0 billion stock repurchase

program. See “Financial Condition and Liquidity — Current Financial Condition” for more information.

RESULTS OF OPERATIONS

Recent Accounting Guidance

See Note 1 to the accompanying consolidated financial statements for a discussion of recent accounting

guidance adopted.

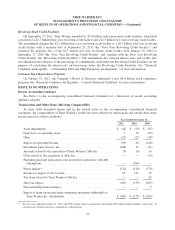

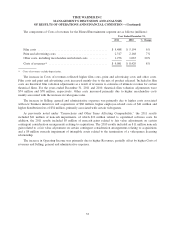

Transactions and Other Items Affecting Comparability

As more fully described herein and in the related notes to the accompanying consolidated financial

statements, the comparability of Time Warner’s results has been affected by transactions and certain other items

in each period as follows (millions):

Year Ended December 31,

2011 2010 2009

Asset impairments .......................................... $ (44) $ (20) $ (85)

Gain (loss) on operating assets ................................. 7 70 (33)

Other ..................................................... (22) (22) (30)

Impact on Operating Income .................................. (59) 28 (148)

Investment gains (losses), net .................................. (168) 32 (21)

Amounts related to the separation of Time Warner Cable Inc. ........ (5) (6) 14

Costs related to the separation of AOL Inc. ....................... — — (15)

Premiums paid and transaction costs incurred in connection with debt

redemptions ............................................. — (364) —

Pretax impact(a) ............................................. (232) (310) (170)

Income tax impact of above items .............................. 43 131 37

Tax items related to Time Warner Cable Inc. .....................——24

After-tax impact ............................................ (189) (179) (109)

Noncontrolling interest impact ................................. — — 5

Impact of items on income from continuing operations attributable to

Time Warner Inc. shareholders .............................. $ (189) $ (179) $ (104)

(a) For the years ended December 31, 2010 and 2009, pretax impact amount does not include $23 million and $2 million, respectively, of

external costs related to mergers, acquisitions or dispositions.

25