Time Magazine 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

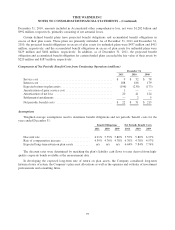

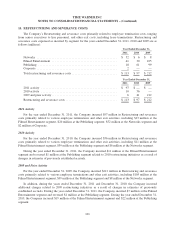

Other information pertaining to each category of equity-based compensation appears below.

Stock Options

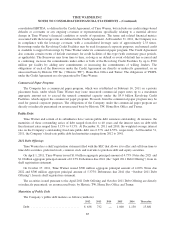

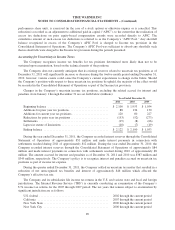

The assumptions presented in the table below represent the weighted-average value of the applicable

assumption used to value stock options at their grant date.

Year Ended December 31,

2011 2010 2009

Expected volatility ................................... 29.5% 29.5% 35.2%

Expected term to exercise from grant date ................. 6.31 years 6.51 years 6.11 years

Risk-free rate ....................................... 2.8% 2.9% 2.5%

Expected dividend yield ............................... 2.6% 3.1% 4.4%

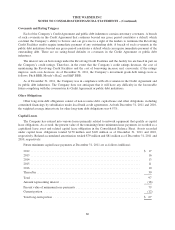

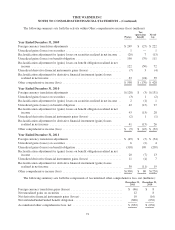

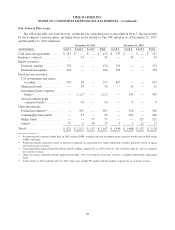

The following table summarizes information about stock options outstanding as of December 31, 2011:

Number

of Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (in years) (thousands)

Outstanding as of December 31, 2010 .......... 134,211 $48.23

Granted .................................. 8,381 36.07

Exercised ................................ (8,142) 25.96

Forfeited or expired ........................ (33,336) 91.37

Outstanding as of December 31, 2011 .......... 101,114 34.80 4.17 $430,199

Exercisable as of December 31, 2011 .......... 78,146 36.84 3.03 $239,863

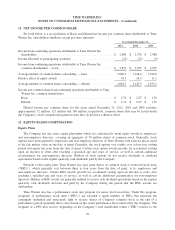

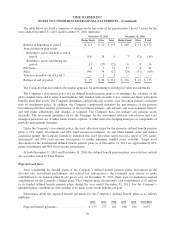

As of December 31, 2011, the number, weighted-average exercise price, aggregate intrinsic value and

weighted-average remaining contractual term of Time Warner stock options vested and expected to vest

approximate amounts for options outstanding. As of December 31, 2011, 56 million shares of Time Warner

common stock were available for future grants of stock options. Total unrecognized compensation cost related to

unvested Time Warner stock option awards as of December 31, 2011, without taking into account expected

forfeitures, is $66 million and is expected to be recognized over a weighted-average period between one and two

years.

The weighted-average fair value of a Time Warner stock option granted during the years ended

December 31, 2011, 2010 and 2009 was $9.01, $6.39 and $5.07, respectively. The total intrinsic value of Time

Warner stock options exercised during the years ended December 31, 2011, 2010 and 2009 was $80 million, $45

million and $13 million, respectively. Cash received from the exercise of Time Warner stock options was $204

million, $121 million and $56 million for the years ended December 31, 2011, 2010 and 2009, respectively. The

tax benefits realized from Time Warner stock options exercised in the years ended December 31, 2011, 2010 and

2009 were $30 million, $17 million and $5 million, respectively.

94