Time Magazine 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

evaluation of the current facts and circumstances surrounding the Guaranteed Obligations and the

Subordinated Indemnity Agreement, the Company is unable to predict the loss, if any, that may be

incurred under these Guaranteed Obligations and no liability for the arrangements has been recognized

at December 31, 2011. Because of the specific circumstances surrounding the arrangements and the

fact that no active or observable market exists for this type of financial guarantee, the Company is

unable to determine a current fair value for the Guaranteed Obligations and related Subordinated

Indemnity Agreement.

• Generally, letters of credit, bank guarantees and surety bonds support performance and payments for a

wide range of global contingent and firm obligations, including insurance, litigation appeals, import of

finished goods, real estate leases and other operational needs. Other contingent commitments primarily

include amounts payable representing contingent consideration on certain acquisitions, which if earned

would require the Company to pay a portion or all of the contingent amount, and contingent payments

for certain put/call arrangements, whereby payments could be made by the Company to acquire assets,

such as a venture partner’s interest or a co-financing partner’s interest in one of the Company’s films.

Time Warner does not guarantee the debt of any of its investments accounted for using the equity method of

accounting.

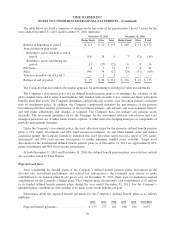

Programming Licensing Backlog

Programming licensing backlog represents the amount of future revenues not yet recorded from cash

contracts for the licensing of theatrical and television product for pay cable, basic cable, network and syndicated

television exhibition. Because backlog generally relates to contracts for the licensing of theatrical and television

product that have already been produced, the recognition of revenue for such completed product is principally

dependent on the commencement of the availability period for telecast under the terms of the related licensing

agreement. Cash licensing fees are collected periodically over the term of the related licensing agreements.

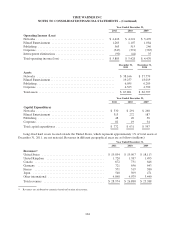

Backlog was approximately $5.6 billion and $5.2 billion at December 31, 2011 and 2010, respectively. Included

in these amounts is licensing of film product from the Filmed Entertainment segment to the Networks segment in

the amount of $1.4 billion and $1.3 billion at December 31, 2011 and 2010, respectively. Backlog excludes

filmed entertainment advertising barter contracts, which are also expected to result in the future realization of

revenues and cash through the sale of the advertising spots received under such contracts to third parties.

Contingencies

In the ordinary course of business, the Company and its subsidiaries are defendants in or parties to various

legal claims, actions and proceedings. These claims, actions and proceedings are at varying stages of

investigation, arbitration or adjudication, and involve a variety of areas of law.

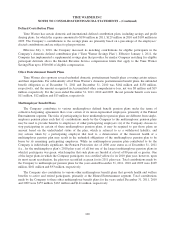

On October 8, 2004, certain heirs of Jerome Siegel, one of the creators of the “Superman” character, filed

suit against the Company, DC Comics and Warner Bros. Entertainment Inc. in the U.S. District Court for the

Central District of California. Plaintiffs’ complaint seeks an accounting and demands up to one-half of the profits

made on Superman since the alleged April 16, 1999 termination by plaintiffs of Siegel’s grants of one-half of the

rights to the Superman character to DC Comics’ predecessor-in-interest. Plaintiffs have also asserted various

Lanham Act and unfair competition claims, alleging “wasting” of the Superman property by DC Comics, and the

Company has filed counterclaims. On March 26, 2008, the court entered an order of summary judgment finding,

among other things, that plaintiffs’ notices of termination were valid and that plaintiffs had thereby recaptured, as

of April 16, 1999, their rights to a one-half interest in the Superman story material, as first published, but that the

accounting for profits would not include profits attributable to foreign exploitation, republication of

pre-termination works and trademark exploitation. On October 6, 2008, the court dismissed plaintiffs’ Lanham

Act and “wasting” claims with prejudice, and subsequently determined that the remaining claims in the case will

be subject to phased non-jury trials. On July 8, 2009, the court issued a decision in the first phase trial in favor of

107