Time Magazine 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

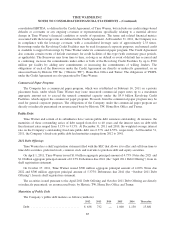

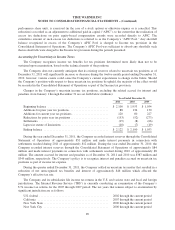

Covenants and Rating Triggers

Each of the Company’s Credit Agreement and public debt indentures contain customary covenants. A breach

of such covenants in the Credit Agreement that continues beyond any grace period constitutes a default, which

can limit the Company’s ability to borrow and can give rise to a right of the lenders to terminate the Revolving

Credit Facilities and/or require immediate payment of any outstanding debt. A breach of such covenants in the

public debt indentures beyond any grace period constitutes a default which can require immediate payment of the

outstanding debt. There are no rating-based defaults or covenants in the Credit Agreement or public debt

indentures.

The interest rate on borrowings under the Revolving Credit Facilities and the facility fee are based in part on

the Company’s credit ratings. Therefore, in the event that the Company’s credit ratings decrease, the cost of

maintaining the Revolving Credit Facilities and the cost of borrowing increase and, conversely, if the ratings

improve, such costs decrease. As of December 31, 2011, the Company’s investment grade debt ratings were as

follows: Fitch BBB, Moody’s Baa2, and S&P BBB.

As of December 31, 2011, the Company was in compliance with all covenants in the Credit Agreement and

its public debt indentures. The Company does not anticipate that it will have any difficulty in the foreseeable

future complying with the covenants in its Credit Agreement or public debt indentures.

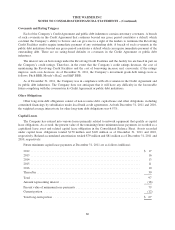

Other Obligations

Other long-term debt obligations consist of non-recourse debt, capital lease and other obligations, including

committed financings by subsidiaries under local bank credit agreements. At both December 31, 2011 and 2010,

the weighted average interest rate for other long-term debt obligations was 4.57%.

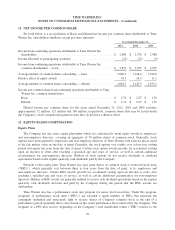

Capital Leases

The Company has entered into various leases primarily related to network equipment that qualify as capital

lease obligations. As a result, the present value of the remaining future minimum lease payments is recorded as a

capitalized lease asset and related capital lease obligation in the Consolidated Balance Sheet. Assets recorded

under capital lease obligations totaled $150 million and $149 million as of December 31, 2011 and 2010,

respectively. Related accumulated amortization totaled $79 million and $81 million as of December 31, 2011 and

2010, respectively.

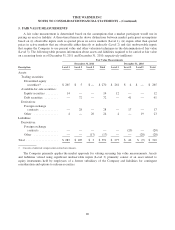

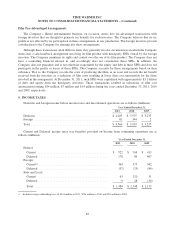

Future minimum capital lease payments at December 31, 2011 are as follows (millions):

2012 ........................................................................ $ 17

2013 ........................................................................ 16

2014 ........................................................................ 13

2015 ........................................................................ 11

2016 ........................................................................ 10

Thereafter .................................................................... 30

Total ........................................................................ 97

Amount representing interest ..................................................... (18)

Present value of minimum lease payments .......................................... 79

Current portion ............................................................... (12)

Total long-term portion ......................................................... $ 67

86