Time Magazine 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

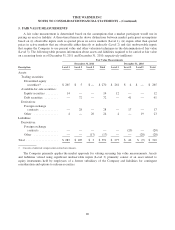

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

contact with the customer, (ii) performs all of the billing and collection activities, and (iii) passes the

proceeds from the subscription to the Publishing segment after deducting the agent’s commission.

Accounting for Collaborative Arrangements

The Company’s collaborative arrangements primarily relate to arrangements entered into with third parties to

jointly finance and distribute theatrical productions (“co-financing arrangements”) and an arrangement entered

into with CBS Broadcasting, Inc. (“CBS”) regarding the exclusive television, Internet and wireless rights to the

NCAA Division I Men’s Basketball Championship events (the “NCAA Tournament”) in the United States and its

territories and possessions from 2011 through 2024.

In most cases, the form of the co-financing arrangement is the sale of an economic interest in a film to an

investor. The Filmed Entertainment segment generally records the amounts received for the sale of an economic

interest as a reduction of the costs of the film, as the investor assumes full risk for that portion of the film asset

acquired in these transactions. The substance of these arrangements is that the third-party investors own an

interest in the film and, therefore, in each period the Company reflects in the Consolidated Statement of

Operations either a charge or benefit to Costs of revenues to reflect the estimate of the third-party investor’s

interest in the profits or losses incurred on the film. The estimate of the third-party investor’s interest in profits or

losses incurred on the film is determined using the film forecast computation method. For the years ended

December 31, 2011, 2010 and 2009, net participation costs of $336 million, $508 million and $321 million,

respectively, were recorded in Costs of revenues.

As it relates to the NCAA Tournament arrangement, the aggregate programming rights fee, production costs,

advertising revenues and sponsorship revenues are equally shared by Turner and CBS. In the event, however, that

the amount paid for the programming rights fee and production costs in any given year exceeds advertising and

sponsorship revenues, CBS’ share of such shortfall is limited to specified annual amounts (the “loss cap”),

ranging from approximately $90 million to $30 million. The amount incurred by the Company pursuant to the

loss cap during the year ended December 31, 2011 was not significant. In accounting for this arrangement, the

Company recorded Advertising revenues for the advertisements aired on Turner’s networks and amortized

Turner’s share of the programming rights fee based on the ratio of current period advertising revenues to its

estimate of total advertising revenues over the term of the arrangement.

Advertising Costs

Time Warner expenses advertising costs as they are incurred, which generally is when the advertising is

exhibited or aired. Advertising expense to third parties was $2.987 billion in 2011, $2.824 billion in 2010 and

$2.562 billion in 2009.

Income Taxes

Income taxes are provided using the asset and liability method, such that income taxes (i.e., deferred tax

assets, deferred tax liabilities, taxes currently payable/refunds receivable and tax expense) are recorded based on

amounts refundable or payable in the current year and include the results of any difference between GAAP and

tax reporting. Deferred income taxes reflect the tax effect of net operating losses, capital losses and tax credit

carryforwards and the net tax effects of temporary differences between the carrying amount of assets and

liabilities for financial statement and income tax purposes, as determined under tax laws and rates. Valuation

allowances are established when management determines that it is more likely than not that some portion or all of

the deferred tax asset will not be realized. The financial effect of changes in tax laws or rates is accounted for in

the period of enactment. The subsequent realization of net operating loss and general business credit

carryforwards acquired in acquisitions accounted for using the purchase method of accounting is recognized in

the Consolidated Statement of Operations. Research and development credits are recorded based on the amount

of benefit the Company believes is more likely than not of being earned. The majority of such research and

73