Time Magazine 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

Noncontrolling Interest Impact

For the year ended December 31, 2009, the noncontrolling interest impact of $5 million reflects the minority

owners’ share of the tax provision related to changes in certain state tax laws on TWC net deferred liabilities.

2011 vs. 2010

Consolidated Results

The following discussion provides an analysis of the Company’s results of operations and should be read in

conjunction with the accompanying Consolidated Statement of Operations.

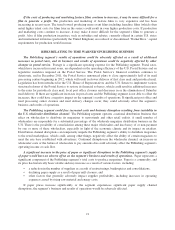

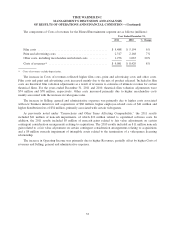

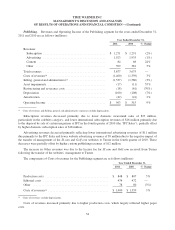

Revenues. The components of revenues are as follows (millions):

Year Ended December 31,

2011 2010 % Change

Subscription ........................................... $ 9,523 $ 9,028 5%

Advertising ........................................... 6,116 5,682 8%

Content .............................................. 12,635 11,565 9%

Other ................................................ 700 613 14%

Total revenues ......................................... $ 28,974 $ 26,888 8%

The increase in Subscription and Advertising revenues was primarily related to an increase at the Networks

segment. The increase in Content revenues was due primarily to increases at the Filmed Entertainment and

Networks segments. Each of the revenue categories is discussed in greater detail by segment in “Business

Segment Results.”

Costs of Revenues. For the year ended December 31, 2011, Costs of revenues increased to $16.311 billion

from $15.023 billion for the year ended December 31, 2010 driven primarily by increases at the Networks and

Filmed Entertainment segments. The segment variations are discussed in “Business Segment Results.”

Selling, General and Administrative Expenses. For the year ended December 31, 2011, Selling, general

and administrative expenses increased 5% to $6.439 billion from $6.126 billion for the year ended December 31,

2010. The increase primarily related to increases at the Networks and Filmed Entertainment segments. The

segment variations are discussed in “Business Segment Results.”

Included in Costs of revenues and Selling, general and administrative expenses is depreciation expense of

$653 million and $674 million for the years ended December 31, 2011 and 2010, respectively.

Amortization Expense. Amortization expense increased to $269 million in 2011 from $264 million in

2010.

Restructuring and Severance Costs. For the year ended December 31, 2011, the Company incurred

Restructuring and severance costs of $113 million, primarily related to employee terminations and other exit

activities, consisting of $52 million at the Networks segment, $41 million at the Filmed Entertainment segment,

$18 million at the Publishing segment and $2 million at the Corporate segment. The total number of employees

terminated across the segments in 2011 was approximately 1,200.

For the year ended December 31, 2010, the Company incurred Restructuring and severance costs of $97

million, primarily related to employee terminations and other exit activities, consisting of $6 million at the

Networks segment, $30 million at the Filmed Entertainment segment and $61 million at the Publishing segment.

The total number of employees terminated across the segments in 2010 was approximately 500.

28