Time Magazine 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

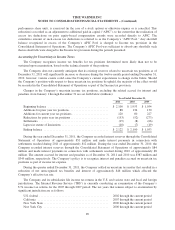

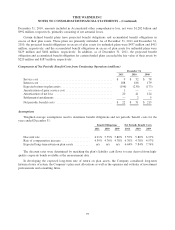

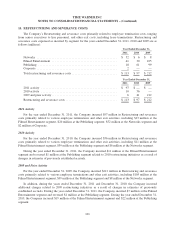

The table below sets forth a summary of changes in the fair value of the pension plan’s Level 3 assets for the

years ended December 31, 2011 and December 31, 2010 (millions):

December 31, 2011 December 31, 2010

Hedge Funds Other Total Hedge Funds Other Total

Balance at beginning of period ........... $ 121 $ 12 $ 133 $ 100 $ 52 $ 152

Actual return on plan assets:

Relating to assets still held at end of

period ........................... (14) 18 4 7 (21) (14)

Relating to assets sold during the

period ........................... 12 (37) (25) 6 8 14

Purchases ............................ 4 7 11 37 4 41

Sales ............................... (46) 34 (12) (29) (31) (60)

Transfers in and/or out of Level 3 ......... — 2 2 — — —

Balance at end of period ................ $ 77 $ 36 $ 113 $ 121 $ 12 $ 133

The Company primarily utilizes the market approach for determining recurring fair value measurements.

The Company’s investment policy for its defined benefit pension plans is to minimize the volatility of the

plan’s funded status and to achieve and maintain fully funded status in order to pay current and future participant

benefits from plan assets. The Company determines and periodically reviews asset allocation policies consistent

with its investment policy. In addition, the Company continuously monitors the performance of the pension

investment portfolios, and the performance of the investment advisers, sub-advisers and asset managers thereof,

and will make adjustments and changes as required. The Company does not manage any pension assets

internally. The investment guidelines set by the Company for the investment advisers, sub-advisers and asset

managers permit the use of index funds, futures, options, or other derivative hedging strategies as components of

portfolio management strategies.

Under the Company’s investment policy, the asset allocation target for the domestic defined benefit pension

plans is 35% equity investments and 65% fixed income investments. As and when funded status and market

conditions permit, the Company intends to transition this asset allocation target toward a target of 20% equity

investments and 80% fixed income investments to further minimize funded status volatility. Target asset

allocations for the international defined benefit pension plans as of December 31, 2011 are approximately 60%

equity investments and 40% fixed income investments.

At both December 31, 2011 and December 31, 2010, the defined benefit pension plans’ assets did not include

any securities issued by Time Warner.

Expected cash flows

After considering the funded status of the Company’s defined benefit pension plans, movements in the

discount rate, investment performance and related tax consequences, the Company may choose to make

contributions to its pension plans in any given year. At December 31, 2011, there were no minimum required

contributions for the Company’s funded plans. The Company made discretionary cash contributions of $1 million

to its funded defined benefit pension plans during the year ended December 31, 2011. For the Company’s

unfunded plans, contributions will continue to be made to the extent benefits are paid.

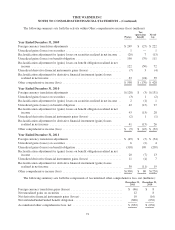

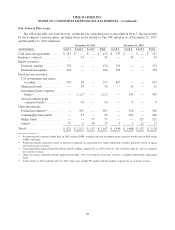

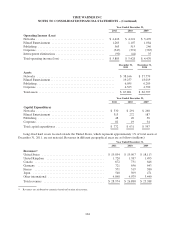

Information about the expected benefit payments for the Company’s defined benefit plans is as follows

(millions):

2012 2013 2014 2015 2016 2017-2021

Expected benefit payments .................. $ 173 177 181 188 194 1,057

99