Time Magazine 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

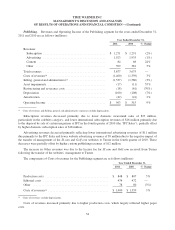

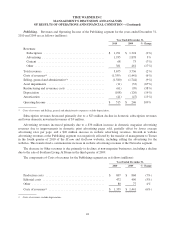

Selling, general and administrative expenses decreased primarily due to cost savings initiatives as well as

$17 million of reductions in expenses due to the transfer of the management of the SI.com and Golf.com websites

to Turner in the fourth quarter of 2010 and the IPC Sales.

As previously noted under “Transactions and Other Items Affecting Comparability,” the 2011 results

included $17 million of noncash impairments of which $11 million related to a tradename impairment. The 2010

results included $11 million of noncash impairments related to certain intangible assets.

Operating Income increased due primarily to lower Selling, general and administrative expenses and lower

Restructuring and severance costs, partially offset by an increase in Costs of revenues.

The Company anticipates that Operating Income at the Publishing segment will decline in the first half of

2012 due primarily to expenses associated with investments related to its digital strategy and increases in

production costs. In addition, the Company is anticipating continued softness in domestic magazine advertising

and newsstand sales during the first quarter of 2012.

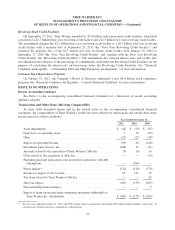

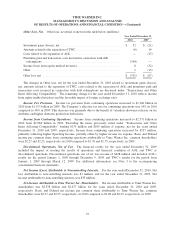

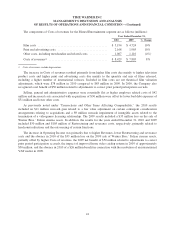

Corporate. Operating Loss of the Corporate segment for the years ended December 31, 2011 and 2010 was

as follows (millions):

Year Ended December 31,

2011 2010 % Change

Selling, general and administrative(a) ......................... $ (316) $ (336) (6%)

Restructuring and severance costs ........................... (2) — NM

Depreciation ............................................ (29) (38) (24%)

Operating Loss .......................................... $ (347) $ (374) (7%)

(a) Selling, general and administrative expenses exclude depreciation.

Operating Loss decreased due primarily to lower legal and other professional fees of $14 million related to

the defense of former employees in various lawsuits and lower depreciation expense due to building

improvements becoming fully depreciated.

For the years ended December 31, 2011 and 2010, Selling, general and administrative expenses included $21

million and $8 million, respectively, of costs related to enterprise efficiency initiatives.

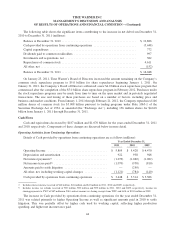

2010 vs. 2009

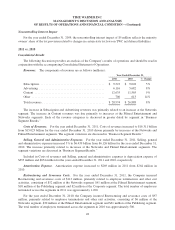

Consolidated Results

The following discussion provides an analysis of the Company’s results of operations and should be read in

conjunction with the accompanying Consolidated Statement of Operations.

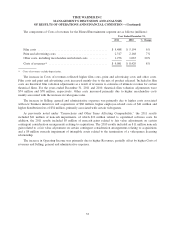

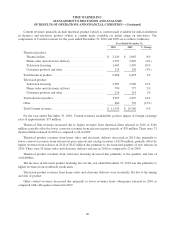

Revenues. The components of revenues are as follows (millions):

Year Ended December 31,

2010 2009 % Change

Subscription ........................................... $ 9,028 $ 8,445 7%

Advertising ........................................... 5,682 5,161 10%

Content .............................................. 11,565 11,074 4%

Other ................................................ 613 708 (13%)

Total revenues ......................................... $ 26,888 $ 25,388 6%

35