Time Magazine 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

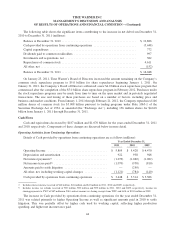

Equity Risk

The Company is exposed to market risk as it relates to changes in the market value of its investments. The

Company invests in equity instruments of public and private companies for operational and strategic business

purposes. These securities are subject to significant fluctuations in fair market value due to the volatility of the

stock markets and the industries in which the companies operate. At December 31, 2011 and 2010, these

securities, which are classified in Investments, including available-for-sale securities in the accompanying

Consolidated Balance Sheet, included $939 million and $883 million, respectively, of investments accounted for

using the equity method of accounting, $204 million and $313 million, respectively, of cost-method investments,

primarily relating to equity interests in privately held businesses, $591 million and $547 million, respectively, of

investments related to the Company’s deferred compensation program and $86 million and $53 million,

respectively, of investments in available-for-sale securities.

The potential loss in fair value resulting from a 10% adverse change in the prices of the Company’s equity-

method investments, cost-method investments and available-for-sale securities would be approximately $125

million. While Time Warner has recognized all declines that are believed to be other-than-temporary, it is

reasonably possible that individual investments in the Company’s portfolio may experience an other-than-

temporary decline in value in the future if the underlying investee company experiences poor operating results or

the U.S. or certain foreign equity markets experience declines in value. In the fourth quarter of 2011, the

Company recorded a $163 million noncash impairment related to its investment in CME. See Note 4 to the

accompanying consolidated financial statements for additional discussion.

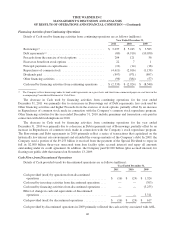

CRITICAL ACCOUNTING POLICIES

The Company’s consolidated financial statements are prepared in accordance with U.S. GAAP, which

requires management to make estimates, judgments and assumptions that affect the amounts reported in the

consolidated financial statements and accompanying notes. Management considers an accounting policy to be

critical if it is important to the Company’s financial condition and results of operations, and if it requires

significant judgment and estimates on the part of management in its application. The development and selection

of these critical accounting policies have been determined by the management of Time Warner and the related

disclosures have been reviewed with the Audit and Finance Committee of the Board of Directors of the

Company. The Company considers policies relating to the following matters to be critical accounting policies:

• Impairment of Goodwill and Intangible Assets;

• Multiple-Element Transactions;

• Income Taxes;

• Film Cost Recognition, Participations and Residuals and Impairments;

• Gross versus Net Revenue Recognition; and

• Sales Returns and Pricing Rebates.

For a discussion of each of the Company’s critical accounting policies, including information and analysis of

estimates and assumptions involved in their application, and other significant accounting policies, see Note 1 to

the accompanying consolidated financial statements.

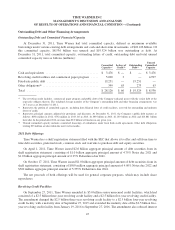

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This 2011 Annual Report to Stockholders contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not

relate strictly to historical or current facts. Forward-looking statements often include words such as “anticipates,”

“estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words and terms of similar substance in

connection with discussions of future operating or financial performance. Examples of forward-looking

statements in this 2011 Annual Report to Stockholders include, but are not limited to, statements regarding (i) the

adequacy of the Company’s liquidity to meet its needs for the foreseeable future, (ii) the Company’s international

53