Time Magazine 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

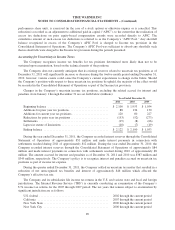

During 2009, the IRS substantially concluded its examination of the Company’s federal income tax returns

for the 2002 — 2004 tax years, which did not result in the Company being required to make any material

payments to the IRS. One matter relating to the character of certain warrants received from a third party has been

referred to the IRS Appeals Division. The Company believes its position with regard to this matter is more likely

than not to be sustained. However, should the IRS prevail, the additional tax payable by the Company would be

approximately $70 million.

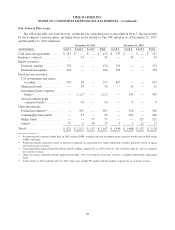

10. SHAREHOLDERS’ EQUITY

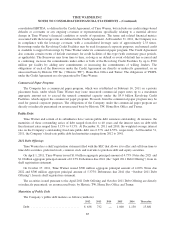

Common Stock Repurchase Program

On January 25, 2011, Time Warner’s Board of Directors authorized an increase in the amount remaining on

the Company’s stock repurchase program to $5.0 billion for share repurchases beginning January 1, 2011. From

January 1, 2011 through December 31, 2011, the Company repurchased approximately 136 million shares of

common stock for approximately $4.618 billion pursuant to trading programs under Rule 10b5-1 of the Securities

Exchange Act of 1934, as amended. On January 31, 2012, Time Warner’s Board of Directors authorized a new

$4.0 billion stock repurchase program. Under stock repurchase programs authorized prior to January 25, 2011,

the Company repurchased approximately 65 million shares of common stock for approximately $1.999 billion in

2010 and approximately 43 million shares of common stock for approximately $1.198 billion in 2009. Purchases

under the stock repurchase program may be made from time to time on the open market and in privately

negotiated transactions. The size and timing of these purchases are based on a number of factors, including price

and business and market conditions.

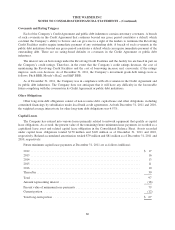

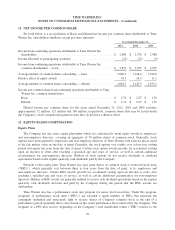

Shares Authorized and Outstanding

At December 31, 2011, shareholders’ equity of Time Warner included 974 million shares of common stock

(net of 678 million shares of common stock held in treasury). As of December 31, 2011, Time Warner is

authorized to issue up to 750 million shares of preferred stock, up to 8.33 billion shares of common stock and up

to 600 million shares of additional series of common stock. At December 31, 2010, shareholders’ equity of Time

Warner included 1.099 billion shares of common stock (net of 542 million shares of common stock held in

treasury).

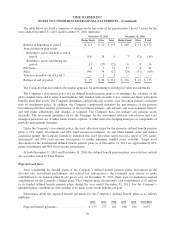

Spin-Offs of TWC and AOL

In connection with the TWC Separation, the Company recognized a reduction of $7.989 billion to

shareholders’ equity, including $1.167 billion attributable to noncontrolling interests. In connection with the

AOL Separation, the Company recognized a reduction of $3.202 billion to shareholders’ equity.

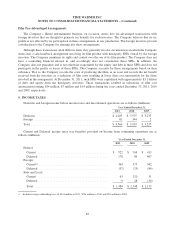

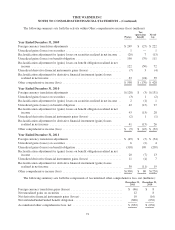

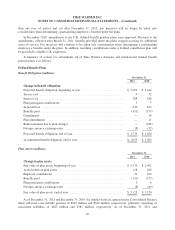

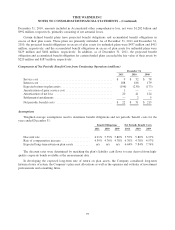

Comprehensive Income

Comprehensive income is reported in the Consolidated Statement of Comprehensive Income and consists of

Net income and other gains and losses affecting shareholders’ equity that, under GAAP, are excluded from Net

income. For Time Warner, such items consist primarily of foreign currency translation gains (losses), unrealized

gains and losses on marketable equity securities, unrealized gains and losses on certain derivative financial

instruments and changes in unfunded and underfunded benefit plan obligations.

90