Time Magazine 2011 Annual Report Download - page 75

Download and view the complete annual report

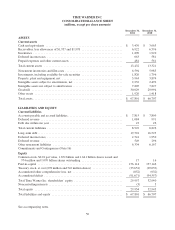

Please find page 75 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Description of Business

Time Warner Inc. (“Time Warner” or the “Company”) is a leading media and entertainment company, whose

businesses include television networks, filmed entertainment and publishing. Time Warner classifies its

operations into three reportable segments: Networks: consisting principally of cable television networks and

premium pay television services that provide programming; Filmed Entertainment: consisting principally of

feature film, television, home video and videogame production and distribution; and Publishing: consisting

principally of magazine publishing. Financial information for Time Warner’s various reportable segments is

presented in Note 15.

Basis of Presentation

Basis of Consolidation

The consolidated financial statements include all of the assets, liabilities, revenues, expenses and cash flows

of entities in which Time Warner has a controlling interest (“subsidiaries”). Intercompany accounts and

transactions between consolidated companies have been eliminated in consolidation.

The financial position and operating results of most of the Company’s foreign operations are consolidated

using the local currency as the functional currency. Local currency assets and liabilities are translated at the rates

of exchange on the balance sheet date, and local currency revenues and expenses are translated at average rates of

exchange during the period. Translation gains or losses on assets and liabilities are included as a component of

Accumulated other comprehensive loss, net.

Reclassifications

Certain reclassifications have been made to the prior year financial information to conform to the

December 31, 2011 presentation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles

(“GAAP”) requires management to make estimates, judgments and assumptions that affect the amounts reported

in the consolidated financial statements and footnotes thereto. Actual results could differ from those estimates.

Significant estimates and judgments inherent in the preparation of the consolidated financial statements

include accounting for asset impairments, multiple-element transactions, allowances for doubtful accounts,

depreciation and amortization, the determination of ultimate revenues as it relates to amortization of capitalized

film and programming costs and participations and residuals, home video and videogames product and magazine

returns, business combinations, pension and other postretirement benefits, equity-based compensation, income

taxes, contingencies, litigation matters, reporting revenue for certain transactions on a gross versus net basis, and

the determination of whether the Company is the primary beneficiary of entities in which it holds variable

interests.

Accounting Guidance Adopted in 2011

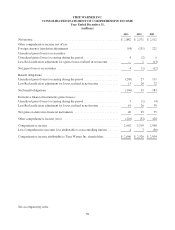

Presentation of Comprehensive Income

In 2011, the Company early adopted guidance on a retrospective basis requiring the presentation of the total

of Comprehensive income, the components of Net income, and the components of Other comprehensive income

in either a single continuous statement of Comprehensive income or in two separate but consecutive

statements and eliminating the option to present the components of Other comprehensive income as part of the

61