Time Magazine 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

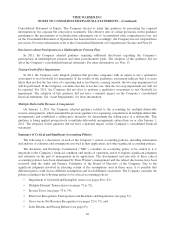

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Consolidated Statement of Equity. The Company elected to adopt this guidance by presenting the required

information in two separate but consecutive statements. The effective date of certain provisions in this guidance

pertaining to the presentation of reclassification adjustments out of Accumulated other comprehensive loss, net

on the Consolidated Statement of Operations has been deferred; accordingly, the Company has not adopted these

provisions. For more information, refer to the Consolidated Statement of Comprehensive Income and Note 10.

Disclosures about Participation in a Multiemployer Pension Plan

In 2011, the Company adopted guidance requiring additional disclosures regarding the Company’s

participation in multiemployer pension and other postretirement plans. The adoption of this guidance did not

affect the Company’s consolidated financial statements. For more information, see Note 13.

Testing Goodwill for Impairment

In 2011, the Company early adopted guidance that provides companies with an option to use a qualitative

assessment to test Goodwill for impairment. If the results of the qualitative assessment indicate that it is more

likely than not that the fair value of a reporting unit is less than its carrying amount, the two-step impairment test

will be performed. If the Company concludes that this is not the case, then the two-step impairment test will not

be required. For 2011, the Company did not elect to perform a qualitative assessment to test Goodwill for

impairment. The adoption of this guidance did not have a material impact on the Company’s consolidated

financial statements. See “Asset Impairments” for more information.

Multiple-Deliverable Revenue Arrangements

On January 1, 2011, the Company adopted guidance related to the accounting for multiple-deliverable

revenue arrangements, which amended the previous guidance for separating consideration in multiple-deliverable

arrangements and established a selling price hierarchy for determining the selling price of a deliverable. This

guidance is being applied prospectively to multiple-deliverable arrangements entered into on or after January 1,

2011. The adoption of this guidance did not have a material impact on the Company’s consolidated financial

statements.

Summary of Critical and Significant Accounting Policies

The following is a discussion of each of the Company’s critical accounting policies, including information

and analysis of estimates and assumptions involved in their application, and other significant accounting policies.

The Securities and Exchange Commission (“SEC”) considers an accounting policy to be critical if it is

important to the Company’s financial condition and results of operations and if it requires significant judgment

and estimates on the part of management in its application. The development and selection of these critical

accounting policies have been determined by Time Warner’s management and the related disclosures have been

reviewed with the Audit and Finance Committee of the Board of Directors of the Company. Due to the

significant judgment involved in selecting certain of the assumptions used in these areas, it is possible that

different parties could choose different assumptions and reach different conclusions. The Company considers the

policies relating to the following matters to be critical accounting policies:

• Impairment of Goodwill and Intangible Assets (see pages 66 to 67);

• Multiple-Element Transactions (see pages 71 to 72);

• Income Taxes (see pages 73 to 74);

• Film Cost Recognition, Participations and Residuals and Impairments (see page 71);

• Gross versus Net Revenue Recognition (see pages 72 to 73); and

• Sales Returns and Pricing Rebates (see page 63).

62