Time Magazine 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

December 31, 2011, and did not assume renewal or replacement of the contracts at the end of their

respective terms. If a contract includes a penalty for non-renewal, the Company has included that

penalty, assuming it will be paid in the period after the contract term expires. If Time Warner can

unilaterally terminate an agreement simply by providing a certain number of days notice or by paying a

termination fee, the Company has included the amount of the termination fee or the amount that would

be paid over the “notice period.” Contracts that can be unilaterally terminated without incurring a

penalty have not been included.

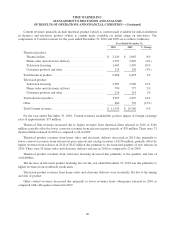

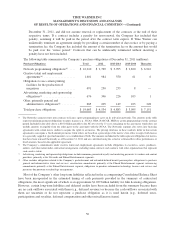

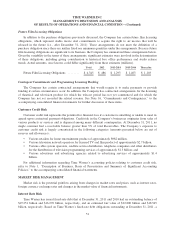

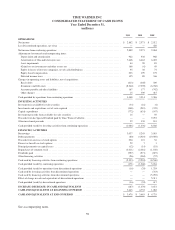

The following table summarizes the Company’s purchase obligations at December 31, 2011 (millions):

Purchase Obligations Total 2012 2013-2014 2015-2016 Thereafter

Network programming obligations(a) .... $ 16,210 $ 2,769 $ 3,705 $ 2,820 $ 6,916

Creative talent and employment

agreements(b) ..................... 1,601 984 550 61 6

Obligations to use certain printing

facilities for the production of

magazines ....................... 491 230 253 8 —

Advertising, marketing and sponsorship

obligations(c) ..................... 676 346 226 103 1

Other, primarily general and

administrative obligations(d) ......... 685 205 149 103 228

Total purchase obligations ............ $ 19,663 $ 4,534 $ 4,883 $ 3,095 $ 7,151

(a) The Networks segment enters into contracts to license sports programming to carry on its television networks. The amounts in the table

represent minimum payment obligations to sports leagues (e.g., NCAA, NBA, NASCAR, MLB) to air the programming over the contract

period. Included in the table above is $10.0 billion payable to the NCAA over the 13 years remaining on the agreement, which does not

include amounts recoupable from the other party to the agreement with the NCAA. The Networks segment also enters into licensing

agreements with certain movie studios to acquire the rights to air movies. The pricing structures in these contracts differ in that certain

agreements can require a fixed amount per movie while others are based on a percentage of the movie’s box office receipts (with license

fees generally capped at specified amounts), or a combination of both. The amounts included in the table represent obligations for movies

that have been released theatrically as of December 31, 2011 and are calculated using the actual or estimated box office performance or

fixed amounts, based on the applicable agreement.

(b) The Company’s commitments under creative talent and employment agreements include obligations to executives, actors, producers,

authors, and other talent under contractual arrangements, including union contracts and contracts with other organizations that represent

such creative talent.

(c) Advertising, marketing and sponsorship obligations include minimum guaranteed royalty and marketing payments to vendors and content

providers, primarily at the Networks and Filmed Entertainment segments.

(d) Other includes obligations related to the Company’s postretirement and unfunded defined benefit pension plans, obligations to purchase

general and administrative items and services, construction commitments primarily at the Filmed Entertainment segment, outsourcing

commitments primarily at the Filmed Entertainment segment, obligations to purchase information technology licenses and services and

payments due pursuant to technology arrangements.

Most of the Company’s other long-term liabilities reflected in the accompanying Consolidated Balance Sheet

have been incorporated in the estimated timing of cash payments provided in the summary of contractual

obligations, the most significant of which is an approximate $1.029 billion liability for film licensing obligations.

However, certain long-term liabilities and deferred credits have been excluded from the summary because there

are no cash outflows associated with them (e.g., deferred revenue) or because the cash outflows associated with

them are uncertain or do not represent a purchase obligation as it is used herein (e.g., deferred taxes,

participations and royalties, deferred compensation and other miscellaneous items).

50