Time Magazine 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

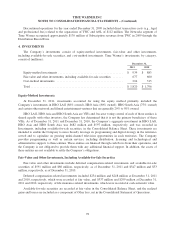

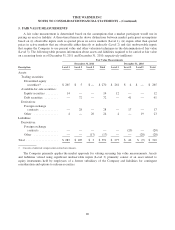

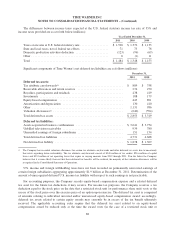

5. FAIR VALUE MEASUREMENTS

A fair value measurement is determined based on the assumptions that a market participant would use in

pricing an asset or liability. A three-tiered hierarchy draws distinctions between market participant assumptions

based on (i) observable inputs such as quoted prices in active markets (Level 1), (ii) inputs other than quoted

prices in active markets that are observable either directly or indirectly (Level 2) and (iii) unobservable inputs

that require the Company to use present value and other valuation techniques in the determination of fair value

(Level 3). The following table presents information about assets and liabilities required to be carried at fair value

on a recurring basis as of December 31, 2011 and December 31, 2010, respectively (millions):

Fair Value Measurements

December 31, 2011 December 31, 2010

Description Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets:

Trading securities:

Diversified equity

securities(a) .......... $ 265 $ 5 $— $ 270 $ 261 $ 4 $ — $ 265

Available-for-sale securities:

Equity securities ........ 14 — — 14 12 — — 12

Debt securities ......... — 72 — 72 — 41 — 41

Derivatives:

Foreign exchange

contracts ............ — 28 — 28 — 17 — 17

Other ................ 4 — 20 24 4 — 19 23

Liabilities:

Derivatives:

Foreign exchange

contracts ............ — — — — — (20) — (20)

Other ................ — — (17) (17) — — (28) (28)

Total ..................... $ 283 $ 105 $ 3 $ 391 $ 277 $ 42 $ (9) $ 310

(a) Consists of deferred compensation related investments.

The Company primarily applies the market approach for valuing recurring fair value measurements. Assets

and liabilities valued using significant unobservable inputs (Level 3) primarily consist of an asset related to

equity instruments held by employees of a former subsidiary of the Company and liabilities for contingent

consideration and options to redeem securities.

80