Time Magazine 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

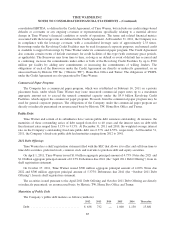

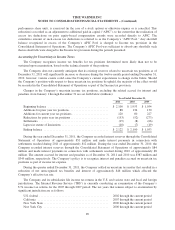

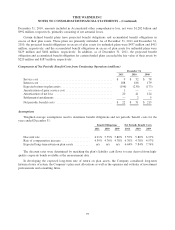

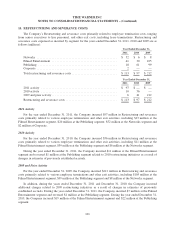

The following summary sets forth the activity within Other comprehensive income (loss) (millions):

Pretax

Tax

(provision)

benefit

Net of

tax

Year Ended December 31, 2009

Foreign currency translation adjustments .................................. $ 249 $ (27) $ 222

Unrealized gains (losses) on securities ..................................... 1 — 1

Reclassification adjustment for (gains) losses on securities realized in net income . . (20) 7 (13)

Unrealized gains (losses) on benefit obligation .............................. 190 (79) 111

Reclassification adjustment for (gains) losses on benefit obligation realized in net

income ........................................................... 122 (50) 72

Unrealized derivative financial instruments gains (losses) ..................... (7) 3 (4)

Reclassification adjustment for derivative financial instrument (gains) losses

realized in net income ............................................... 63 (24) 39

Other comprehensive income (loss) ....................................... $ 598 $ (170) $ 428

Year Ended December 31, 2010

Foreign currency translation adjustments .................................. $(128) $ (3) $ (131)

Unrealized gains (losses) on securities ..................................... (3) 1 (2)

Reclassification adjustment for (gains) losses on securities realized in net income . . 2 (1) 1

Unrealized gains (losses) on benefit obligation .............................. 42 (15) 27

Reclassification adjustment for (gains) losses on benefit obligation realized in net

income ........................................................... 43 (15) 28

Unrealized derivative financial instruments gains (losses) ..................... (2) 1 (1)

Reclassification adjustment for derivative financial instrument (gains) losses

realized in net income ............................................... 41 (15) 26

Other comprehensive income (loss) ....................................... $ (5) $ (47) $ (52)

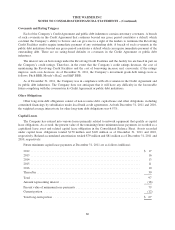

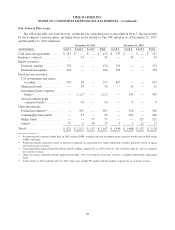

Year Ended December 31, 2011

Foreign currency translation adjustments .................................. $ (49) $ (5) $ (54)

Unrealized gains (losses) on securities ..................................... 6 (2) 4

Unrealized gains (losses) on benefit obligation .............................. (318) 109 (209)

Reclassification adjustment for (gains) losses on benefit obligation realized in net

income ........................................................... 20 (7) 13

Unrealized derivative financial instruments gains (losses) ..................... 11 (4) 7

Reclassification adjustment for derivative financial instrument (gains) losses

realized in net income ............................................... 30 (11) 19

Other comprehensive income (loss) ....................................... $(300) $ 80 $ (220)

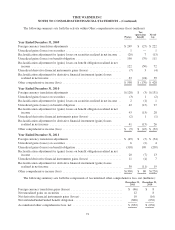

The following summary sets forth the components of Accumulated other comprehensive loss, net (millions):

December 31,

2011

December 31,

2010

Foreign currency translation gains (losses) .................................. $ (46) $ 8

Net unrealized gains on securities ......................................... 12 8

Net derivative financial instruments gains (losses) ............................ 10 (16)

Net unfunded/underfunded benefit obligation ................................ (828) (632)

Accumulated other comprehensive loss, net ................................. $ (852) $ (632)

91