Time Magazine 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

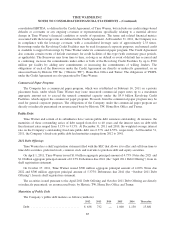

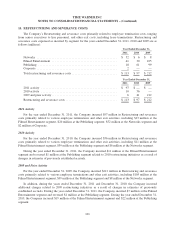

Restricted Stock Units and Target Performance Stock Units

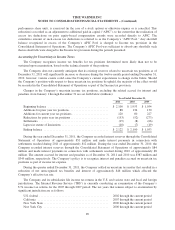

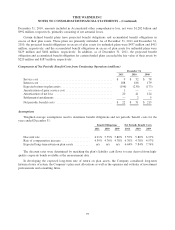

The following table summarizes information about unvested RSUs and target PSUs as of December 31,

2011:

Number of

Shares/Units

Weighted-

Average

Grant Date

Fair Value

(thousands)

Unvested as of December 31, 2010 ................................. 16,723 $ 25.25

Granted ...................................................... 5,291 36.26

Vested ....................................................... (3,779) 33.73

Forfeited ...................................................... (926) 25.32

Unvested as of December 31, 2011 ................................. 17,309 26.76

As of December 31, 2011, the intrinsic value of unvested RSUs and target PSUs was $626 million. Total

unrecognized compensation cost related to unvested RSUs and target PSUs as of December 31, 2011, without

taking into account expected forfeitures, was $183 million and is expected to be recognized over a weighted-

average period between one and two years. The fair value of RSUs that vested during the years ended

December 31, 2011, 2010 and 2009 was $117 million, $95 million and $76 million, respectively. The fair value

of PSUs that vested during 2011, 2010, and 2009 was $10 million, $12 million, and $2 million respectively.

For the year ended December 31, 2011, the Company granted 5.1 million RSUs at a weighted-average grant

date fair value per RSU of $36.00. For the year ended December 31, 2010, the Company granted 5.7 million

RSUs at a weighted-average grant date fair value per RSU of $27.21. For the year ended December 31, 2009, the

Company granted 4.7 million RSUs at a weighted-average grant date fair value per RSU of $22.34.

For the year ended December 31, 2011, the Company granted 0.1 million target PSUs at a weighted-average

grant date fair value per PSU of $45.89. For the year ended December 31, 2010, the Company granted

0.2 million target PSUs at a weighted-average grant date fair value per PSU of $30.65. For the year ended

December 31, 2009, the Company granted 0.2 million target PSUs at a weighted-average grant date fair value per

PSU of $23.67.

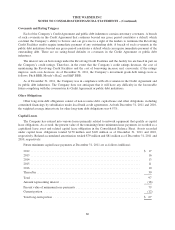

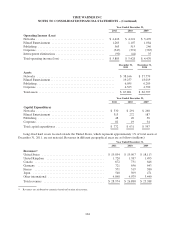

Equity-Based Compensation Expense

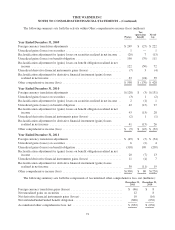

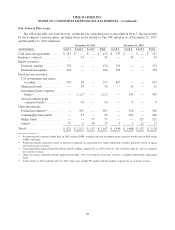

Compensation expense recognized for equity-based compensation plans is as follows (millions):

Year Ended December 31,

2011 2010 2009

Stock options ................................................. $ 70 $ 70 $ 74

Restricted stock units and performance stock units ................... 155 129 101

Total impact on Operating Income ................................ $ 225 $ 199 $ 175

Tax benefit recognized ......................................... $ 82 $ 76 $ 67

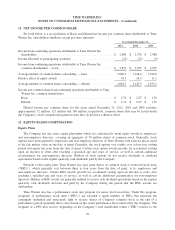

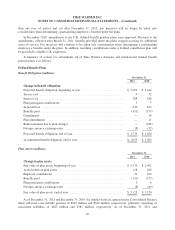

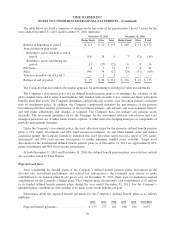

13. BENEFIT PLANS

Retirement Plan Amendments

In March 2010, the Company’s Board of Directors approved amendments to its domestic defined benefit

pension plans. Pursuant to the amendments, (i) effective after June 30, 2010, benefits provided under the plans

stopped accruing for additional years of service and the plans were closed to new hires and employees with less

95