Royal Caribbean Cruise Lines 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

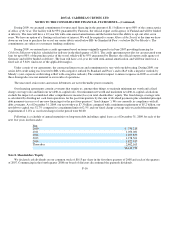

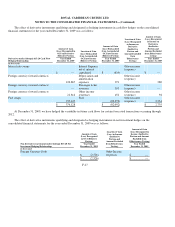

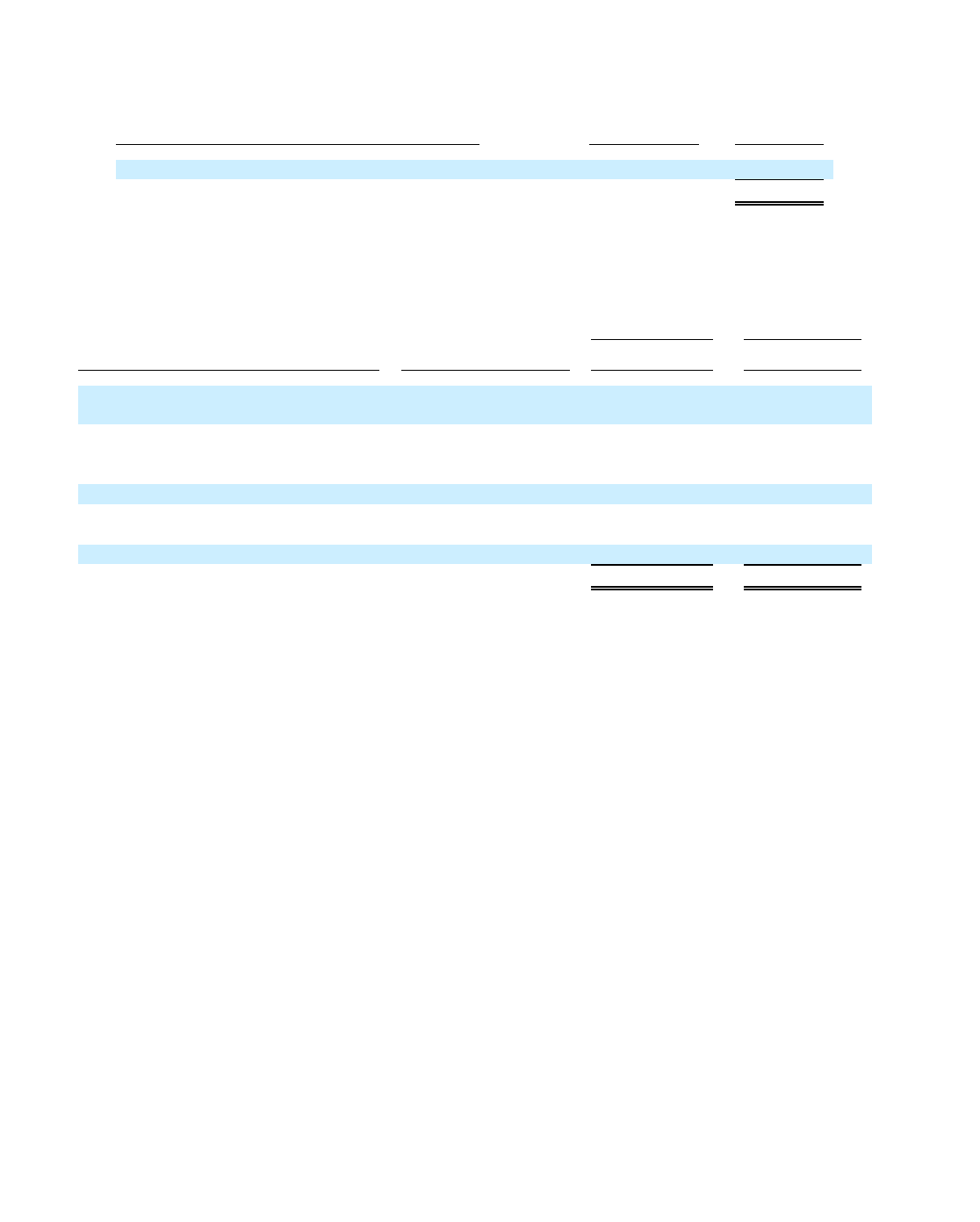

At December 31, 2009, the fair value and line item caption of non-derivative instruments recorded was as follows:

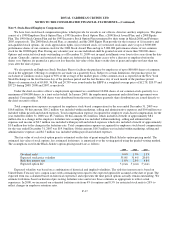

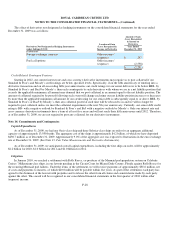

The effect of derivative instruments qualifying and designated as hedging instruments and the related hedged items in fair value

hedges on the consolidated statement of operations for the year ended December 31, 2009 was as follows:

F-26

Non-derivative instrument designated as hedging instrument

under Subto

p

ic 815-20

Balance Sheet

Location Carr

y

in

g

Value

I

n thousands

Foreign currency deb

t

Long-term debt

$(701,523)

$ (701,523)

Derivatives and related Hedged Items under

Subto

p

ic 815-20 Fair Value Hed

g

in

g

Relationshi

p

s

Location of Gain (Loss)

Recognized in Income on

Derivative and Hedged

Item

Amount of Gain

(Loss) Recognized in

Income on Derivative

Amount of Gain

(Loss) Recognized in

Income on Hedged

Item

Year Ended

December 31, 2009

Year Ended

December 31, 2009

I

n thousands

Interest rate swaps

Interest expense, net of

interest capitalized

$45,466

$

—

Cross currency swaps

Interest expense, net of

interest capitalized

4,394

—

Interest rate swaps

Other income (expense)

(8,134)

2,105

Cross currency swaps

Other income (expense)

6,756

(10,170)

Foreign currency forward contracts

Other income (expense)

28,517

(25,295)

$76,999

$ (33,360)