Royal Caribbean Cruise Lines 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Occupancy, in accordance with cruise vacation industry practice, is calculated by dividing Passenger Cruise Days by APCD. A

percentage in excess of 100% indicates that three or more passengers occupied some cabins.

Passenger Cruise Days represent the number of passengers carried for the period multiplied by the number of days of their

respective cruises.

The use of certain significant non-GAAP measures, such as Net Yields and Net Cruise Costs, allow us to perform capacity and

rate analysis to separate the impact of known capacity changes from other less predictable changes which affect our business. We

believe these non-GAAP measures provide expanded insight to measure revenue and cost performance in addition to the standard

United States GAAP based financial measures. There are no specific rules or regulations for determining non-GAAP measures, and as

such, there exists the possibility that they may not be comparable to other companies within the industry.

Executive Overview

Total revenues were $5.9 billion in 2009 compared to total revenues of $6.5 billion in 2008. Our financial results have been, and

may continue to be, negatively affected by the economic environment including the high unemployment rates in certain markets. This

challenging economic environment has strained consumer discretionary spending, which in turn has caused a diminished demand for

our cruises and land-based tours to Mexico and the Caribbean. In addition, the adverse impact of the H1N1 flu virus had a significant

effect on Pullmantur’s operations during 2009. Nonetheless, we believe the resiliency of the cruise vacation industry coupled with the

endurance of our brands allowed us to mitigate, to an extent, the impact of the economic environment on our 2009 results.

In late 2009, we began to experience growth in our order book and a diminishing gap in year-over-year booked volume

comparisons. This acceleration in booking volumes has had a positive effect on pricing, which is running ahead of the same time last

year. In addition, the design of our Solstice and Oasis-class ships allows for a greater percentage of staterooms with verandas and

outside staterooms which provide for premiums in pricing. Although we are not back to pre-recession demand levels, there is solid

yield recovery underway. As a result, we expect 2010 Net Yields to increase in the range of 3% to 6% compared to 2009.

Furthermore, we have responded to the operating environment by continuously improving our cost focus through the

implementation of new cost-containment initiatives including the renegotiation of long-term contracts with our vendors and a detailed

emphasis on cost control. In addition, our Solstice and Oasis-class ships provide us with cost efficiencies through their scale and fuel

efficiencies. We expect our 2010 Net Cruise Costs per APCD to be from flat to up slightly compared to 2009.

While cutting costs throughout the organization, we have not altered our strategy of substantially growing our sourcing of

international guests. We continue to opportunistically increase our investments in growth outside North America with the goal of

diversifying our sources and increasing opportunities for revenue growth. We are also continuing our strategy of tactically spending

to maintain brand standards.

Lastly, we believe the credit and capital markets have begun to stabilize. This has improved our ability to secure financing and

raise additional capital on terms that are acceptable to us. We currently have three Solstice-class vessels and one Oasis-class vessel

under construction, all of which have committed bank financing arrangements. We anticipate funding our scheduled maturities in

2010 through operating cash flows and do not foresee a need to access the capital markets during 2010 although we may

opportunistically decide to do so. We are also continuing to pursue our long-term objective of returning to investment grade rating.

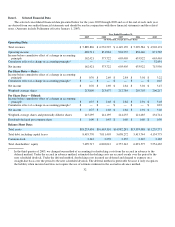

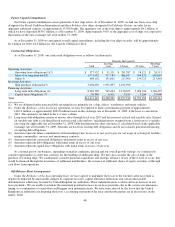

Summary of Historical Results of Operations

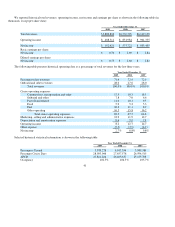

Total revenues decreased 9.8% to $5.9 billion in 2009 from total revenues of $6.5 billion in 2008 primarily due to the decrease

in ticket prices. Net Yields decreased by approximately 14.2% compared to 2008. The decrease in Net Yields was primarily due to the

decrease in ticket prices, partially offset by decreases in operating expenses. As a result, our net income was $162.4 million or $0.75

per share on a diluted basis for 2009 compared to $573.7 million or $2.68 per share on a diluted basis for 2008.

39