Royal Caribbean Cruise Lines 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

During 2009, we arranged commitments for unsecured financing in the amount of $1.1 billion or up to 80% of the contract price

of Allure of the Seas. The facility will be 95% guaranteed by Finnvera, the official export credit agency of Finland and will be funded

at delivery. The loan will have a 12-year life with semi-annual amortization and the lenders have the ability to opt-out after seven

years. We have an option of a floating or fixed rate of interest. We will be required to secure Allure of the Seas if at the time we draw

down on our loan to purchase the vessel our senior debt is rated below BB- by Standard & Poor’s or below Ba3 by Moody’s. The

commitments are subject to customary funding conditions.

During 2009, we entered into a credit agreement based on terms originally agreed to in June 2007 providing financing for

Celebrity Silhouette which is scheduled for delivery in the third quarter of 2011. The credit agreement provides for an unsecured term

loan for up to 80% of the purchase price of the vessel which will be 95% guaranteed by Hermes, the official export credit agency of

Germany and will be funded at delivery. The loan will have a 12-year life with semi-annual amortization, and will bear interest at a

fixed rate of 5.82% (inclusive of the applicable margin).

Under certain of our agreements, the contractual interest rate and commitment fee vary with our debt rating. During 2009, our

senior debt credit rating was lowered to BB- with a negative outlook by Standard and Poor’s and to Ba3 with a negative outlook by

Moody’s (our corporate credit rating is Ba2 with a negative outlook). The cumulative impact to interest expense in 2009 as a result of

these downgrades was not material to our results of operations.

The unsecured senior notes and senior debentures are not redeemable prior to maturity.

Our financing agreements contain covenants that require us, among other things, to maintain minimum net worth and a fixed

charge coverage ratio and limit our net debt-to-capital ratio. Our minimum net worth and maximum net debt-to-capital calculations

exclude the impact of accumulated other comprehensive income (loss) on total shareholders’ equity. The fixed charge coverage ratio

is calculated by dividing net cash from operations for the past four quarters by the sum of dividend payments plus scheduled principal

debt payments in excess of any new financings for the past four quarters (“fixed charges”). We are currently in compliance with all

debt covenants. As of December 31, 2009, our net worth was $7.3 billion compared with a minimum requirement of $5.2 billion, our

net-debt-to-capital was 52.7% compared to a maximum limit of 62.5% and our fixed charge coverage ratio exceeded the minimum

requirement of 1.25x as our fixed charges for the period were $0.00.

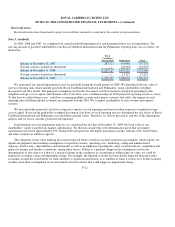

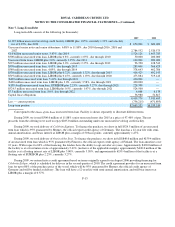

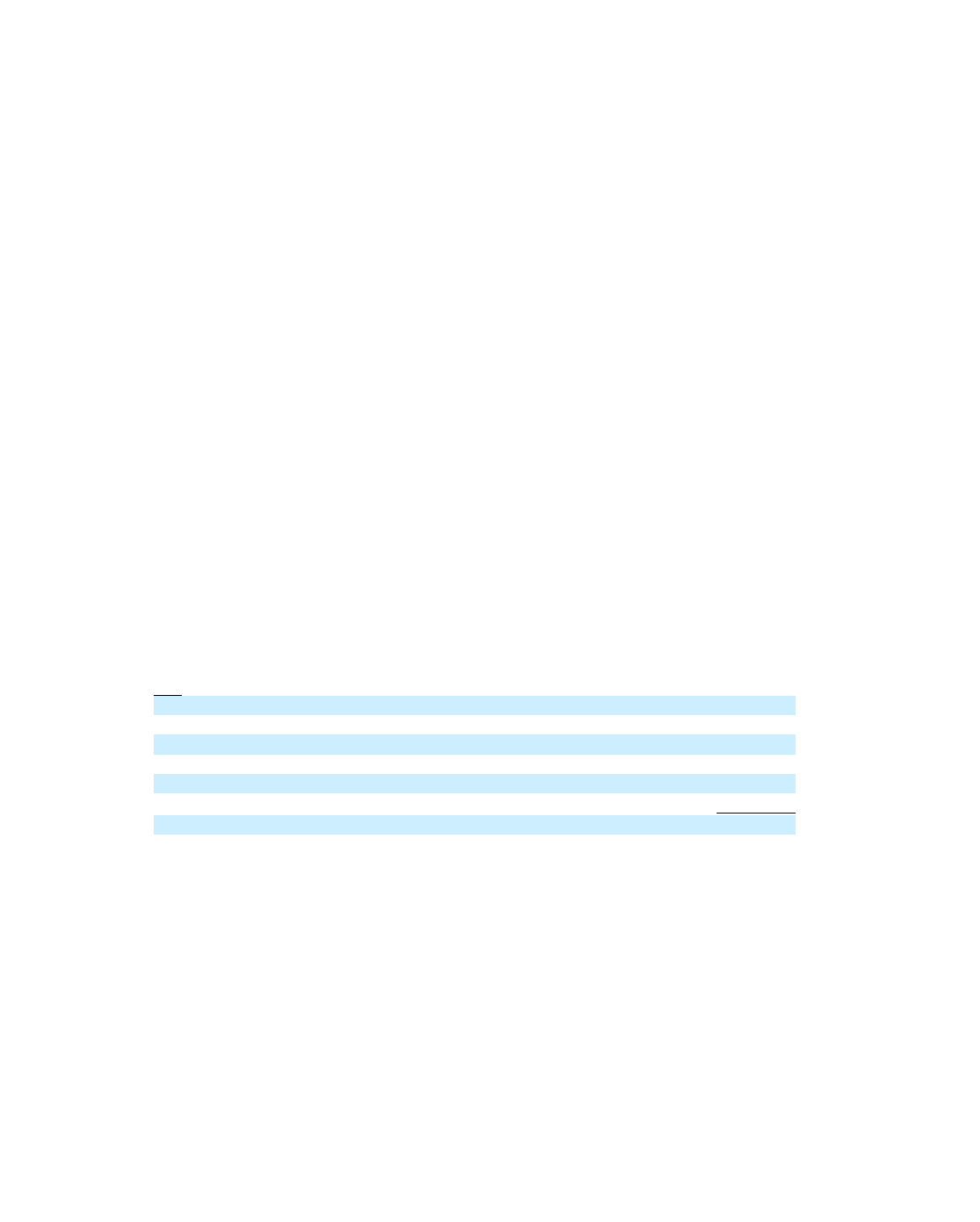

Following is a schedule of annual maturities on long-term debt including capital leases as of December 31, 2009 for each of the

next five years (in thousands):

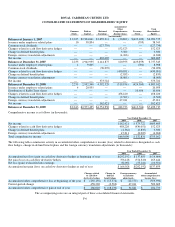

Note 8. Shareholders’ Equity

We declared cash dividends on our common stock of $0.15 per share in the first three quarters of 2008 and each of the quarters

of 2007. Commencing in the fourth quarter 2008 our board of directors discontinued the quarterly dividends.

F-16

Year

2010

$756,215

2011

1,056,081

2012

1,103,833

2013

1,278,561

2014

1,822,917

Thereafter

2,402,163

$8,419,770