Royal Caribbean Cruise Lines 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders

When I wrote to you at this time last year, we were facing

unprecedented global economic headwinds and 2009 looked

to be a challenging year. And it was. Unemployment rose to

unprecedented levels, consumer spending slowed, credit

markets fell apart and the entire global economy retrenched

at an astonishing pace.

Thankfully, we weathered that storm better than many

other businesses that rely on discretionary spending. It has

been incredibly painful, but ironically has actually served to

validate the resilience of our company and our industry. The

difficult but necessary cost cutting initiated in mid-2008 really

proved its worth as the magnitude of this cycle began to

unfold. In addition, our heavy investment in global expansion

helped keep our vessels at full capacity by expanding our

guest sourcing pool. And our financing relationships and

commitments served us well, allowing us to raise affordable

debt in an otherwise desert-like financial landscape.

We should not forget that we offer a fantastic product with

broad appeal and high satisfaction ratings and it is that

formula that gives us the strength to see through such

difficult times. Simply put, our guests love us and the value

of our product has resonated with a cautious and strained

consumer during this cycle.

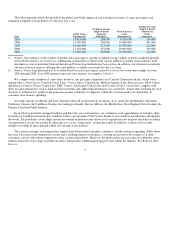

Financial Health

Our 2009 profitability was significantly reduced from

previous periods, but we continued to generate a great

deal of cash – over $1 billion of EBITDA was created

during 2009 and we maintained a liquidity level of about

$1 billion, consistent with past practices. Particularly

strong performance from our newest ships, continued

cost diligence and a proactive approach to managing fuel

risk combined with a strong wave season and a modest

improvement in the consumer landscape are expected

to generate significant improvements in 2010 earnings

relative to 2009. EBITDA generation is expected to grow

substantially as well.

Looking to 2010, I am pleased that we are moving toward an

improving operating environment and improving profitability.

While this is good news, I want to be careful to not give the

impression that we are returning quickly to “the good old

days.” Much of the improvement in 2010 is coming from our

newest ships while the remaining fleet continues to perform

well below their 2008 peaks. Spain, in particular, remains a

challenge and our Pullmantur brand is navigating an economy

that comparatively speaking is in much worse shape than our

other operating theaters. Long-term, Pullmantur remains a

strong strategic fit for our brand portfolio, but we expect that

2010 will bring only marginal improvement in this segment of

our business.

More broadly, we still have a long way to go in achieving

an acceptable return profile for our investors. Accordingly,

we have an all-hands focus at the company on improving

our Return on Invested Capital by taking advantage of the

success of our latest ships, exploiting our international

growth and controlling our costs. And, we expect to do so

while simultaneously strengthening our balance sheet and

improving our creditworthiness. This is a lofty goal, and we

have been hard at work laying a foundation that will help us

accomplish it in reasonable order. In conjunction with a slowly

improving economy, there are some specific focuses that

will help propel us toward our improved profitability goals.

Interestingly, they are many of the same proactive decisions

that buoyed the company’s results in 2009 – diversified

global sourcing, smart hardware investments and strong

cost controls.

Globalization, Brand Expansion and Satisfaction

During 2009, 46% of ticket revenues came from outside the

United States compared to about 10% earlier in the decade.

This is important for two reasons. First, it provides us with

the flexibility to source the vessels according to demand.

For example, when consumers were hesitant to purchase

transatlantic airfare during the summer of 2009, we sourced

a higher percentage of guests locally than we would have

2 Royal Caribbean Cruises Ltd.