Royal Caribbean Cruise Lines 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

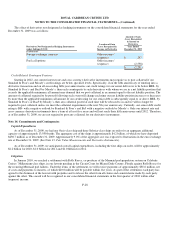

In September 2009, demands for arbitration were made under our collective bargaining agreement covering Celebrity Cruises’

crewmembers on behalf of twenty current and/or former Celebrity Cruises’ cabin stewards and others similarly situated (the

“September 2009 Demands”). These demands contend that between 2001 and 2005 Celebrity Cruises improperly required the named

cabin stewards to share guest gratuities with assistant cabin stewards. The demands seek payment of damages, including penalty

wages, under the U.S. Seaman’s Wage Act of approximately $0.6 million for the named crewmembers and estimates damages in

excess of $200.0 million, for the entire class of other similarly situated crewmembers. In October 2009, and again in December 2009,

additional demands for arbitration were made under our collective bargaining agreement covering Celebrity Cruises’ crewmembers

by the same counsel on behalf of a total of three current and/or former Celebrity Cruises’ cabin stewards and others similarly situated,

making the same contentions and seeking the same damages as in the September 2009 Demands. A similar action brought by this

same counsel in October 2009 on behalf of ten crew members and others similarly situated in the Southern District Court, Southern

District of Florida making the same contentions and seeking the same damages as the arbitration demands was dismissed with

prejudice. We believe we have meritorious defenses to the pending arbitration demands which we intend to vigorously pursue.

We are routinely involved in other claims typical within the cruise vacation industry. The majority of these claims are covered

by insurance. We believe the outcome of such claims, net of expected insurance recoveries, will not have a material adverse impact

on our financial condition or results of operations.

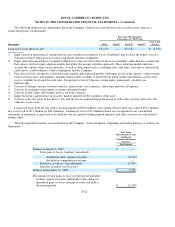

Operating Leases

In 2002, we entered into an operating lease denominated in British pound sterling for the Brilliance of the Seas. The lease

payments vary based on sterling LIBOR. The lease has a contractual life of 25 years; however, the lessor has the right to cancel the

lease at years 10 and 18. Accordingly, the lease term for accounting purposes is 10 years. In the event of early termination at year 10,

we have the option to cause the sale of the vessel at its fair value and use the proceeds toward the applicable termination obligation

plus any unpaid amounts due under the contractual term of the lease. Alternatively, we can make a termination payment of

approximately £126.0 million, or approximately $203.8 million based on the exchange rate at December 31, 2009, if the lease is

canceled in 2012, and relinquish our right to cause the sale of the vessel. This is analogous to a guaranteed residual value. This

termination amount, which is our maximum exposure, has been included in the table below for noncancelable operating leases. Under

current circumstances we do not believe early termination of this lease is probable.

Under the Brilliance of the Seas operating lease, we have agreed to indemnify the lessor to the extent its after-tax return is

negatively impacted by unfavorable changes in corporate tax rates, capital allowance deductions and certain unfavorable

determinations which may be made by United Kingdom tax authorities. These indemnifications could result in an increase in our

lease payments. We are unable to estimate the maximum potential increase in our lease payments due to the various circumstances,

timing or a combination of events that could trigger such indemnifications. We have been advised by the lessor that the United

Kingdom tax authorities are disputing the lessor’s accounting treatment of the lease and that the parties are in discussions on the

matter. If the characterization of the lease is ultimately determined to be incorrect, we could be required to indemnify the lessor under

certain circumstances. The lessor has advised us that they believe their characterization of the lease is correct. Based on the foregoing

and our review of available information, we do not believe an indemnification is probable. However, if the lessor loses its dispute and

we are required to indemnify the lessor, we cannot at this time predict the impact that such an occurrence would have on our financial

condition and results of operations.

F-30