Royal Caribbean Cruise Lines 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

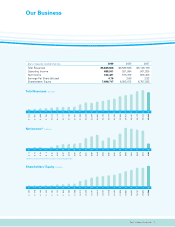

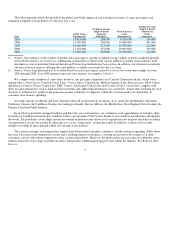

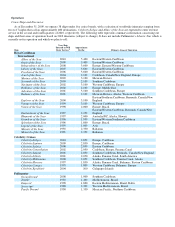

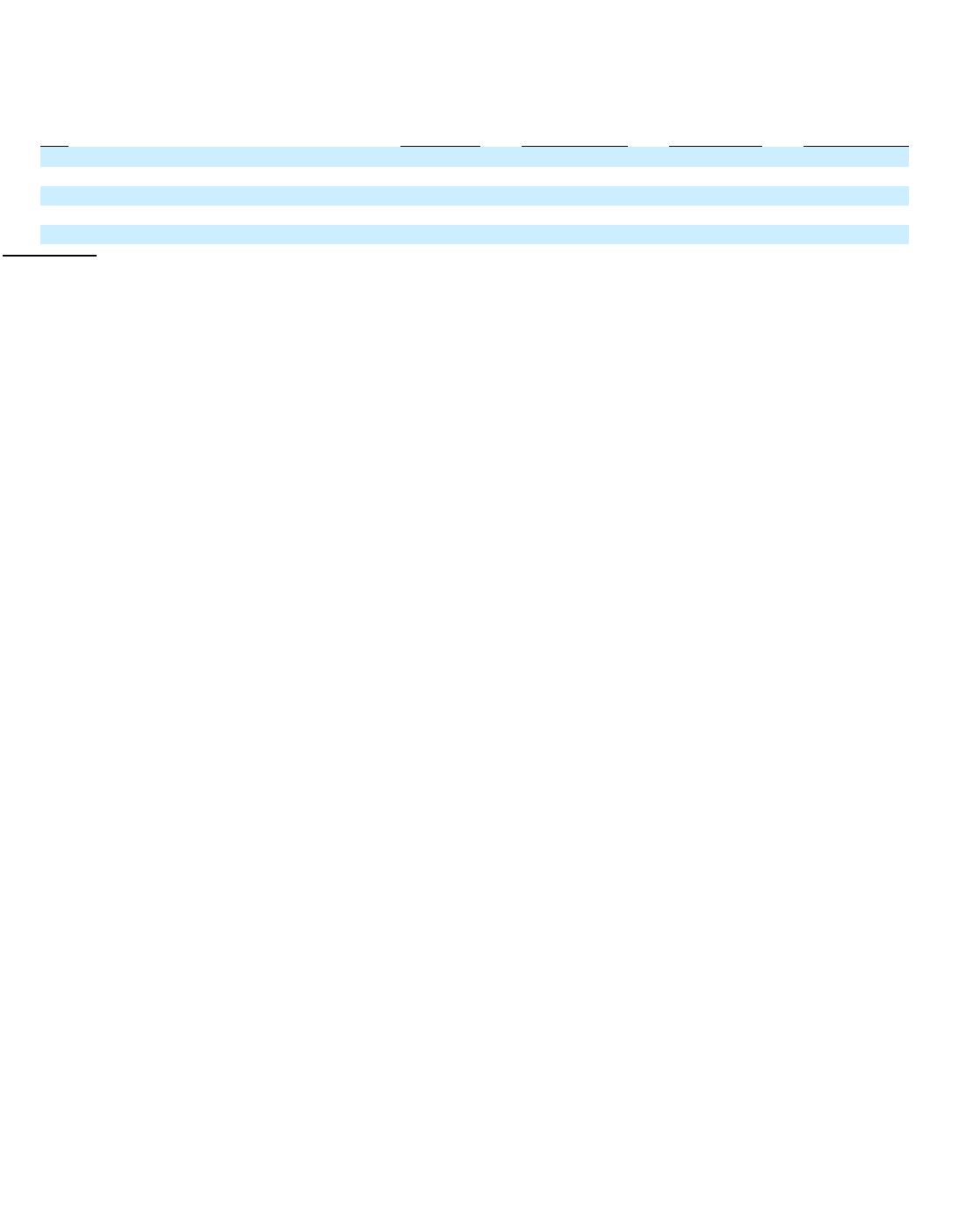

The following table details the growth in the global and North American cruise markets in terms of cruise passengers and

estimated weighted-average berths over the past five years:

We compete with a number of cruise lines; however, our principal competitors are Carnival Corporation & plc, which owns,

among others, Aida Cruises, Carnival Cruise Lines, Costa Cruises, Cunard Line, Holland America Line, Iberocruceros, P&O Cruises

and Princess Cruises; Disney Cruise Line; MSC Cruises; Norwegian Cruise Line and Oceania Cruises. Cruise lines compete with

other vacation alternatives such as land-based resort hotels and sightseeing destinations for consumers’ leisure time. Demand for such

activities is influenced by political and general economic conditions. Companies within the vacation market are dependent on

consumer discretionary spending.

Our ships operate worldwide and have itineraries that call on destinations in Alaska, Asia, Australia, the Bahamas, Bermuda,

California, Canada, the Caribbean, Europe, the Galapagos Islands, Hawaii, Mexico, the Middle East, New England, New Zealand, the

Panama Canal and South America.

In an effort to penetrate untapped markets and diversify our customer base, we continue to seek opportunities to redeploy ships

in our Royal Caribbean International, Celebrity Cruises and Azamara Club Cruises brands to new markets and itineraries throughout

the world. The portability of our ships and our investment in infrastructure allows us to expand into new markets and helps us reduce

our dependency on any one market by allowing us to create “home ports” around the world. In addition, it allows us to readily

redeploy our ships to meet demand within our existing cruise markets.

The current economic environment has significantly deteriorated consumer confidence and discretionary spending. While there

has been a decrease in the demand for cruises and a resulting drop in cruise prices, cruising has proven to be resilient as it offers

consumers a good value when compared to other vacation alternatives. However, the projected increase in capacity within the cruise

industry from new cruise ships currently on order could produce additional pricing pressures within the industry. See Item 1A. Risk

Factors.

4

Year

Global Cruise

Passen

g

ers(1)

Weighted-Average

Supply of Berths

Marketed

Globall

y

(1)

North American

Cruise

Passen

g

ers(2)

Weighted-Average

Supply of Berths

Marketed in

North

America(1)

2005

14,818,000

288,000

9,909,000

190,000

2006

15,309,000

304,000

10,080,000

201,000

2007

16,586,000

327,000

10,330,000

212,000

2008

17,184,000

347,000

10,093,000

219,000

2009

17,340,000

363,000

10,169,000

222,000

1) Source: Our estimates of the number of global cruise passengers, and the weighted-average supply of berths marketed globally

and in North America are based on a combination of data that we obtain from various publicly available cruise industry trade

information sources including Seatrade Insider and Cruise Line International Association. In addition, our estimates incorporate

our own statistical analysis utilizing the same publicly available cruise industry data as a base.

2) Source: Cruise Line International Association based on cruise passengers carried for at least two consecutive nights for years

2005 through 2008. Year 2009 amounts represent our estimates (see number 1 above).