Royal Caribbean Cruise Lines 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of this initiative, we incurred charges, all of which were cash charges, of $14.3 million, or $0.07 per share in 2008,

comprised of $9.0 million in termination benefits and $5.3 million in contract termination costs. Expenses related to termination

benefits were included in marketing, selling and administrative expenses and contract termination costs were included in other

operating expenses in the consolidated statements of operations. As of December 31, 2008, we paid approximately $6.9 million of the

termination benefits and all of the contract termination costs. These termination benefits were paid in 2009.

Recently Adopted, and Future Application of, Accounting Standards

Refer to Note 2. Summary of Significant Accounting Policies to our consolidated financial statements for further information on

R

ecently Adopted Accounting Standards and Future Application of Accounting Standards.

Liquidity and Capital Resources

Sources and Uses of Cash

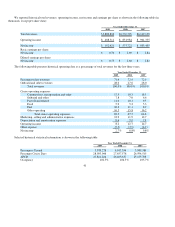

Cash flow generated from operations provides us with a significant source of liquidity. Net cash provided by operating activities

decreased $226.4 million to $844.9 million for 2009 compared to $1.1 billion in 2008. The decrease is primarily due to a decrease in

cash generated from ticket and onboard sales during 2009 compared to 2008. The decrease in cash from ticket sales is a result of a

compression in the booking window, forward bookings lagging behind the prior year and cruises being purchased for lower prices

compared to the prior year. As a result of the above factors, we received an estimated $371.3 million less in customer deposits during

2009 as compared to 2008. The decrease in onboard and other revenues is due to less spending per guest as compared to the prior

year. The decreases mentioned above were partially offset primarily by a decrease in payments to suppliers and vendors due to our

continued focus on cost improvement.

Net cash used in investing activities increased to $2.3 billion in 2009 from $2.0 billion in 2008. The increase was primarily due

to an increase in capital expenditures which were $2.5 billion in 2009, compared to $2.2 billion in 2008. Capital expenditures were

primarily related to the delivery of Oasis of the Seas and Celebrity Equinox in 2009 as compared to Independence of the Seas and

Celebrity Solstice in 2008. The increase was also related to a decrease in settlements of approximately $159.0 million on our foreign

currency forward contracts and an increase in equity contributions to our unconsolidated affiliates of $129.4 million. The increases

mentioned above were partially offset by the proceeds received from the sale of Celebrity Galaxy to TUI Cruises of $290.9 million in

2009 compared to proceeds from the sale of our investment in Island Cruises of $51.4 million in 2008.

Net cash provided by financing activities was $1.3 billion in 2009 compared to $1.1 billion in 2008. This change was primarily

due to a decrease in dividends paid of approximately $128.0 million during 2009 as compared to 2008. The change was also due to an

increase in debt proceeds of approximately $93.8 million and a decrease in repayments of debt of approximately $39.1 million.

During 2009, we received $840.0 million and €€159.4 (or approximately $228.4 million based on the exchange rate at December 31,

2009), through an unsecured term loan due through 2021 to purchase Oasis of the Seas and $524.5 million through an unsecured term

loan due through 2021 to purchase Celebrity Equinox. We also received net proceeds of $285.4 million from our $300.0 million

senior unsecured notes issued during 2009. In addition, we borrowed approximately $425.0 million under our unsecured revolving

credit facility of which we repaid approximately $375.0 million. We made debt repayments on various loan facilities and capital

leases, including a pre-payment of approximately $100.0 million to retire our unsecured term loan, LIBOR plus 1.38%, due

November 2010. This change was offset by an increase in debt issuance costs of $37.3 million primarily related to the Oasis of the

Seas and Celebrity Equinox financings.

Interest capitalized during 2009 decreased to $41.1 million from $44.4 million in 2008 primarily due to lower interest rates.

47