Royal Caribbean Cruise Lines 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The impact of disruptions in the global financial markets may affect the ability of our counterparties and others to perform their

obligations to us.

The economic events during 2008 and 2009, including failures of financial service companies and the related liquidity crisis,

disrupted the capital and credit markets. A recurrence of these disruptions could cause our counterparties and others to breach their

obligations to us under our contracts with them. This could include failures of banks or other financial service companies to fund

required borrowings under our loan agreements or to pay us amounts that may become due under our derivative contracts for hedging

of fuel prices, interest rates and foreign currencies or other agreements. If this occurs it may have a negative impact on our cash flows

including our ability to meet our obligations, results of operations and financial condition.

The increase in capacity resulting from delivery of newbuilds currently on order within the cruise industry could further adversely

impact the demand for cruises or cruise pricing.

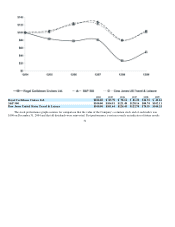

A total of 27 new ships are on order for delivery through 2013 in the cruise industry, four of which are ours. The current

worldwide economic environment has led to lower cruise prices and lower onboard purchases, all of which have adversely affected

our revenues. The further growth in capacity from these new ships, without an increase in the cruise industry’s share of the vacation

market, could further depress cruise prices and compound our ability to achieve yield improvement.

We may lose business to competitors throughout the vacation market.

We operate in the vacation market and cruising is one of many alternatives for people choosing a vacation. We therefore risk

losing business not only to other cruise lines, but also to other vacation operators, which provide other leisure options including

hotels, resorts and package holidays and tours.

We face significant competition from other cruise lines on the basis of cruise pricing, travel agent preference and also in terms

of the nature of ships and services we offer to passengers. Our principal competitors within the cruise vacation industry include

Carnival Corporation & plc, which owns, among others, Aida Cruises, Carnival Cruise Lines, Costa Cruises, Cunard Line, Holland

America Line, Iberocruceros, P&O Cruises and Princess Cruises; Disney Cruise Line; MSC Cruises; Norwegian Cruise Line and

Oceania Cruises.

In the event that we do not compete effectively with other vacation alternatives and cruise companies or our competitors offer

travel agents higher commission rates and incentives in the future, our results of operations and financial position could be adversely

affected.

Fears of terrorist and pirate attacks, war, and other hostilities and the spread of contagious diseases could have a negative impact on

our results of operations.

Events such as terrorist and pirate attacks, war, and other hostilities and the resulting political instability, travel restrictions, the

spread of contagious diseases and concerns over safety, health and security aspects of traveling have had, and could have in the

future, a significant adverse impact on demand and pricing in the travel and vacation industry. These events could also impact our

ability to source qualified crew from throughout the world at competitive costs and, therefore, increase our shipboard employee costs.

I

ncidents or adverse publicity concerning the cruise vacation industry or unusual weather conditions could affect our reputation and

harm our future sales and results of operations.

The operation of cruise ships involves the risk of accidents, illnesses and other incidents which may bring into question

passenger safety, health, security and vacation satisfaction and create a perception that cruising is more dangerous than other vacation

alternatives. Incidents involving cruise ships, adverse media publicity concerning the cruise vacation industry or unusual weather

patterns or natural disasters, such as hurricanes and earthquakes, could impact demand and consequently have an adverse impact on

our results of operations and on future industry performance.

22