Royal Caribbean Cruise Lines 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

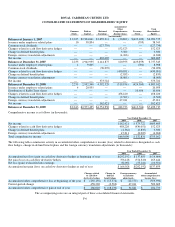

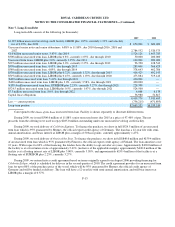

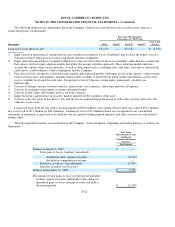

Note 7. Long-Term Debt

Long-term debt consists of the following (in thousands):

During 2009, we issued $300.0 million of 11.88% senior unsecured notes due 2015 at a price of 97.40% of par. The net

proceeds from the offering were used to repay $285.0 million outstanding under our unsecured revolving credit facility.

During 2009, we took delivery of Celebrity Equinox. To finance the purchase, we drew in full $524.5 million of an unsecured

term loan which is 95% guaranteed by Hermes, the official export credit agency of Germany. The loan has a 12-year life with semi-

annual amortization, and bears interest at LIBOR plus a margin of 50 basis points, currently approximately 1.47%.

During 2009, we took delivery of Oasis of the Seas. To finance the purchase, we drew in full $840.0 million and €€159.4 million

of an unsecured term loan which is 95% guaranteed by Finnvera, the official export credit agency of Finland. The loan amortizes over

12 years. With respect to 60% of the financing, the lenders have the ability to opt-out after six years. Approximately $420.0 million of

the facility is at a fixed interest rate of approximately 5.41% (inclusive of the applicable margin); approximately $420.0 million of the

facility is at a floating interest rate of LIBOR plus 3.00%, currently 3.58%; and approximately €€159.4 million of the facility is at a

floating rate of EURIBOR plus 2.25%, currently 3.27%.

During 2009, we entered into a credit agreement based on terms originally agreed to in August 2006 providing financing for

Celebrity Eclipse, which is scheduled for delivery in the second quarter of 2010. The credit agreement provides for an unsecured term

loan for up to 80% of the purchase price of the vessel which will be 95% guaranteed by Hermes, the official credit agency of

Germany and will be funded at delivery. The loan will have a 12-year life with semi-annual amortization, and will bear interest at

LIBOR plus a margin of 0.37%.

F-15

2009 2008

$1.225 billion unsecured revolving credit facility, LIBOR plus 1.05%, currently 1.33% and a facility

fee of 0.25%, due 2012

$650,000

$600,000

Unsecured senior notes and senior debentures, 6.88% to 11.88%, due 2010 through 2016, 2018 and

2027

2,784,552

2,520,575

€

€1.0 billion unsecured senior notes, 5.63%, due 2014

1,526,126

1,463,785

$300 million unsecured term loan, LIBOR plus 0.8%, currently 1.05%, due through 2010

50,000

200,000

Unsecured term loans, LIBOR plus 3.0%, currently 3.25%, due 2011

100,000

200,000

$225 million unsecured term loan, LIBOR plus 2.0%, currently 2.25%, due through 2012

96,390

128,543

$570 million unsecured term loan, 4.45%, due through 2013

285,000

366,429

$589 million unsecured term loan, 4.89%, due through 2014

378,643

462,786

$530 million unsecured term loan, LIBOR plus 0.72%, currently 1.32%, due through 2015

416,429

492,143

$519 million unsecured term loan, LIBOR plus 0.45%, currently 1.03%, due through 2020

475,884

519,146

$420 million unsecured term loan, 5.41%, due through 2021

420,000

—

$420 million unsecured term loan, LIBOR plus 3.0%, currently 3.58%, due through 2021

420,000

—

€

€159.4 million unsecured term loan, EURIBOR plus 2.25%, currently 3.27%, due through 2021

228,398

—

$524.5 million unsecured term loan, LIBOR plus 0.5%, currently 1.47%, due through 2021

524,500

—

$7.3 million unsecured term loan, 8.0%, due through 2022

6,868

6,179

Capital lease obligations

56,980

51,817

8,419,770

7,011,403

Less

—

current portion

(756,215)

(471,893)

Long-term portion

$7,663,555

$6,539,510

Correspond to the Oasis o

f

the Seas unsecured term loan. Facility is shown separately to illustrate different terms.

1

1

1

1