Royal Caribbean Cruise Lines 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

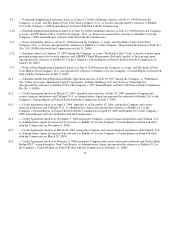

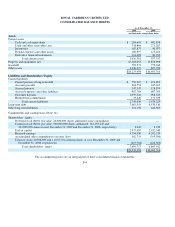

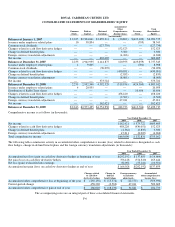

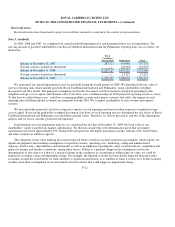

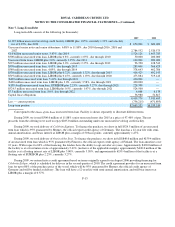

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

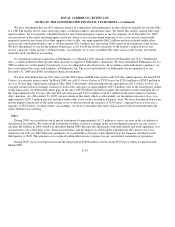

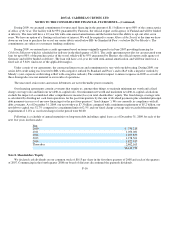

Comprehensive income is as follows (in thousands):

The following tables summarize activity in accumulated other comprehensive income (loss) related to derivatives designated as cash

flow hedges, change in defined benefit plans and the foreign currency translation adjustments (in thousands):

The accompanying notes are an integral part of these consolidated financial statements.

F-6

Common

Stock

Paid-in

Ca

p

ital

Retained

Earnin

g

s

Accumulated

Other

Comprehensive

Income (Loss)

Treasury

Stock

Total

Shareholders’

E

q

uit

y

(in thousands)

Balances at Januar

y

1, 2007

$2,225

$2,904,041

$3,639,211

$(30,802)

$(423,100)

$6,091,575

Issuance under employee related plans

10

38,894

—

—

(559)

38,345

Common stock dividends

—

—

(127,739)

—

—

(127,739)

Changes related to cash flow derivative hedges

—

—

—

152,523

—

152,523

Change in defined benefit plans

—

—

—

3,500

—

3,500

Foreign currency translation adjustments

—

—

—

(4,266)

—

(4,266)

Net income

—

—

603,405

—

—

603,405

Balances at December 31, 2007

2,235

2,942,935

4,114,877 120,955

(423,659)

6,757,343

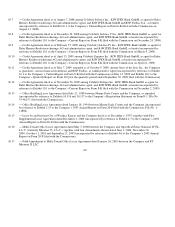

Issuance under employee related plans

4

9,605

—

—

(701)

8,908

Common stock dividends

—

—

(96,070)

—

—

(96,070)

Changes related to cash flow derivative hedges

—

—

—

(430,051)

—

(430,051)

Change in defined benefit plans

—

—

—

(2,835)

—

(2,835)

Foreign currency translation adjustments

—

—

—

(8,005)

—

(8,005)

Net income

—

—

573,722

—

—

573,722

Balances at December 31, 2008

2,239

2,952,540

4,592,529

(319,936)

(424,360)

6,803,012

Issuance under employee related plans

4

20,955

—

—

—

20,959

Distribution of Rabbi Trust shares

—

—

—

—

10,656

10,656

Changes related to cash flow derivative hedges

—

—

—

458,220

—

458,220

Change in defined benefit plans

—

—

—

(2,562)

—

(2,562)

Foreign currency translation adjustments

—

—

—

47,011

—

47,011

Net income

—

—

162,421

—

—

162,421

Balances at December 31, 2009

$2,243

$2,973,495

$4,754,950

$ 182,733

$(413,704)

$7,499,717

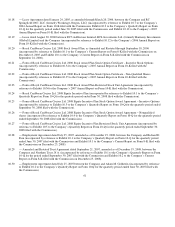

Year Ended December 31,

2009 2008 2007

Net income

$162,421

$573,722

$603,405

Changes related to cash flow derivative hedges

458,220

(430,051)

152,523

Change in defined benefit plans

(2,562)

(2,835)

3,500

Foreign currency translation adjustments

47,011

(8,005)

(4,266)

Total comprehensive income

$665,090

$132,831

$755,162

Year Ended December 31

,

2009 2008 2007

Accumulated net (loss) gain on cash flow derivative hedges at beginning of year

$(292,192)

$137,859

$(14,664)

Net gain (loss) on cash flow derivative hedges

376,128

(374,810)

163,444

Net loss (gain) reclassified into earnings

82,092

(55,241)

(10,921)

Accumulated net gain (loss) on cash flow derivative hedges at end of year

$ 166,028

$(292,192)

$137,859

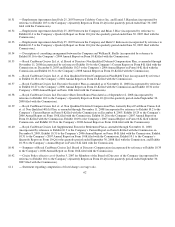

Changes related

to cash flow

derivative hed

g

es

Change in

defined

benefit

p

lans

Foreign currency

translation

ad

j

ustments

Accumulated

other comprehensive

income

(

loss

)

Accumulated other comprehensive loss at beginning of the year

$(292,192)

$(15,574)

$(12,170)

$(319,936)

Current-period change

458,220

(2,562)

47,011

502,669

Accumulated other comprehensive gain at end of year

$166,028

$(18,136)

$34,841

$182,733