Royal Caribbean Cruise Lines 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

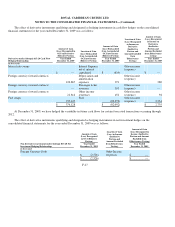

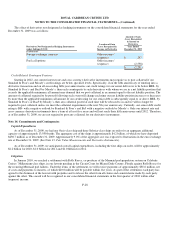

The effect of derivative instruments qualifying and designated as hedging instruments in cash flow hedges on the consolidated

financial statements for the year ended December 31, 2009 was as follows:

At December 31, 2009, we have hedged the variability in future cash flows for certain forecasted transactions occurring through

2012.

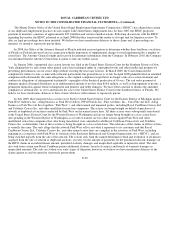

The effect of derivative instruments qualifying and designated as hedging instruments in net investment hedges on the

consolidated financial statements for the year ended December 31, 2009 was as follows:

F-27

Derivatives under Subtopic 815-20 Cash Flow

Hed

g

in

g

Relationshi

p

s

Amount of Gain

(Loss) Recognized in

OCI on Derivative

(Effective Portion)

Location of Gain

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

Amount of Gain

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

Location of Gain

(Loss) Recognized

in Income on

Derivative

(Ineffective

Portion and

Amount Excluded

from

Effectiveness

Testin

g

)

Amount of Gain

(Loss) Recognized

in Income on

Derivative

(Ineffective

Portion and

Amount Excluded

from Effectiveness

testin

g

)

Year Ended

December 31, 2009

Year Ended

December 31, 2009

Year Ended

December 31, 2009

I

n thousands

Interest rate swaps

$

—

Interest Expense,

net of interest

capitalized

$(619)

Other income

(expense)

$

—

Foreign currency forward contracts

120,867

Depreciation and

amortization

expenses

271

Other income

(expense)

280

Foreign currency forward contracts

—

Passenger ticket

revenues

103

Other income

(expense)

—

Foreign currency forward contracts

21,814

Other income

(expense)

452

Other income

(expense)

94

Fuel swaps

233,447

Fuel

(82,299)

Other income

(expense)

2,361

$ 376,128

$ (82,092)

$2,735

Non-derivatives instrument under Subtopic 815-20 Net

Investment Hed

g

in

g

Relationshi

p

s

Amount of Gain

(Loss) Recognized

in OCI (Effective

Portion)

Location of Gain

(Loss) in Income

(Ineffective

Portion and

Amount Excluded

from Effectiveness

Testin

g

)

Amount of Gain

(Loss) Recognized in

Income (Ineffective

Portion and Amount

Excluded from

Effectiveness Testin

g

)

Year Ended

December 31, 2009

Year Ended

December 31, 2009

I

n thousands

Foreign Currency Debt

$(2,526)

Other Income

(expense)

$

—

$ (2,526)

$

—