Royal Caribbean Cruise Lines 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

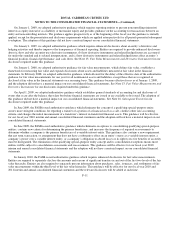

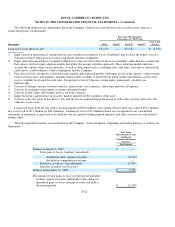

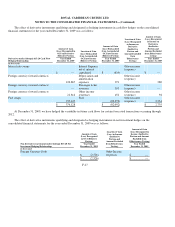

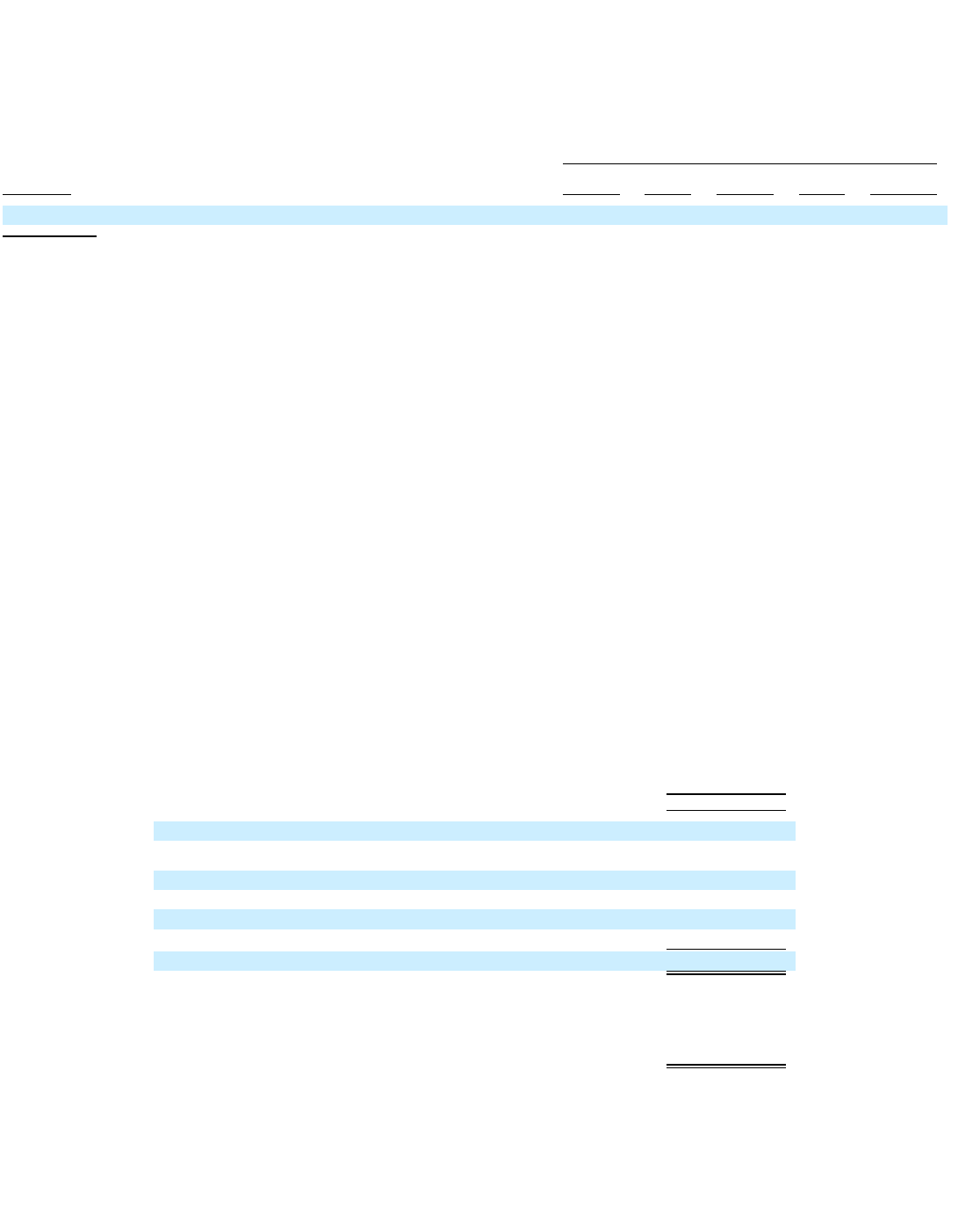

The following table presents information about the Company’s long-lived assets held for sale recorded at fair value on a

nonrecurring basis (in thousands):

Long-lived assets held for sale with a carrying amount of $56.6 million, were written down to their fair value of $52.3 million,

less cost to sell of $2.7 million (or $49.6 million), resulting in a loss of $7.0 million which was recognized in our consolidated

statements of operations. Long-lived assets held for sale are reported within prepaid expenses and other assets in our consolidated

balance sheet.

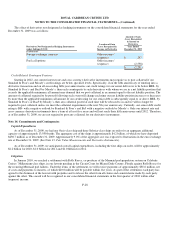

The following table presents a reconciliation of the Company’s fuel call options’ beginning and ending balances as follows (in

thousands):

F-21

Fair Value Measurements

at December 31, 2009 Usin

g

Descri

p

tion Total Level 1 Level 2 Level 3

Total Gains

(Losses)

Long-lived assets held for sale

$52,252

—

$52,252

—

$(6,972)

1. Inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access.

Valuation of these items does not entail a significant amount of judgment.

2. Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Fair value is derived using valuation models that utilize the income valuation approach. These valuation models take into

account the contract terms such as maturity, as well as other inputs such as exchange rates, fuel types, fuel curves, interest rate

yield curves, creditworthiness of the counterparty and the Company.

3. Fair value for fuel call options is derived using standard option pricing models with inputs based on the options’ contract terms,

such as exercise price and maturity, and data either readily available or derived from public market information, such as fuel

curves, volatility levels and discount rates. Categorized as Level 3 because certain inputs (principally volatility) are

unobservable.

4. Consists of foreign currency forward contracts, interest rate, cross currency, fuel swaps and fuel call options.

5. Consists of exchange-traded equity securities and mutual funds.

6. Consists of fuel swaps and foreign currency forward contracts.

7. Inputs based on a quoted price in an active market adjusted for the condition of the asset.

8. Consists of the fair value of the Atlantic Star and the loss recognized during the period to reduce the carrying value to its fair

value less cost to sell.

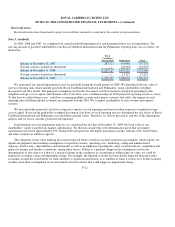

Fair Value

Measurements Using

Significant

Unobservable Inputs

(Level 3)

Fuel O

p

tions

Balance at January 1, 2009

$

—

Total gains or losses (realized / unrealized)

Included in other (expense) income

(2,538)

Included in comprehensive income

—

Purchases, issuances, and settlements

12,536

Transfers in and/or out of Level 3

—

Balance at December 31, 2009

$9,998

The amount of total gains or losses for the period included

in other (expense) income attributable to the change in

unrealized gains or losses relating to assets still held at

the reporting date

$(2,538)

173

8