Royal Caribbean Cruise Lines 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

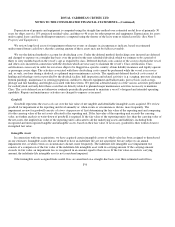

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1. General

Description of Business

We are a global cruise company. We own five cruise brands, Royal Caribbean International, Celebrity Cruises, Pullmantur,

Azamara Club Cruises, and CDF Croisières de France with a combined total of 38 ships at December 31, 2009. Our ships operate on

a selection of worldwide itineraries that call on approximately 400 destinations. We also have a 50% investment in a joint venture

with TUI AG which operates the brand TUI Cruises. Celebrity Galaxy, a 1,850-berth ship, previously part of Celebrity Cruises, was

sold to TUI Cruises to serve as its first ship and has been sailing under the name Mein Schiff since May 2009.

Basis for Preparation of Consolidated Financial Statements

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United

States of America. Estimates are required for the preparation of financial statements in accordance with these principles. Actual

results could differ from these estimates. All significant intercompany accounts and transactions are eliminated in consolidation and

we include Pullmantur’s results of operations on a two-month lag to allow for more timely preparation of our consolidated financial

statements. We consolidate entities over which we have control, usually evidenced by a direct ownership interest of greater than 50%

and variable interest entities where we are determined to be the primary beneficiary. For affiliates where significant influence over

financial and operating policies exists, usually evidenced by a direct ownership interest from 20% to 50%, the investment is

accounted for using the equity method.

Note 2. Summary of Significant Accounting Policies

Revenues and Expenses

Deposits received on sales of passenger cruises are initially recorded as customer deposit liabilities on our balance sheet.

Customer deposits are subsequently recognized as passenger ticket revenues, together with revenues from onboard and other goods

and services and all associated direct costs of a voyage, upon completion of voyages with durations of ten days or less, and on a pro-

rata basis for voyages in excess of ten days.

Cash and Cash Equivalents

Cash and cash equivalents include cash and marketable securities with original maturities of less than 90 days.

Inventories

Inventories consist of provisions, supplies and fuel carried at the lower of cost (weighted-average) or market.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and amortization. We capitalize interest as part of the

cost of acquiring certain assets. Improvement costs that we believe add value to our ships are capitalized as additions to the ship and

depreciated over the improvements’ estimated useful lives. The estimated cost and accumulated depreciation of replaced or

refurbished ship components are written off and any resulting losses are recognized in cruise operating expenses. Liquidated damages

received from shipyards as a result of the late delivery of a new ship are recorded as reductions to the cost basis of the ship.

F-7