Royal Caribbean Cruise Lines 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

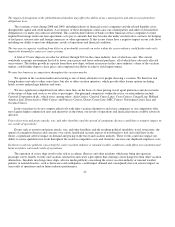

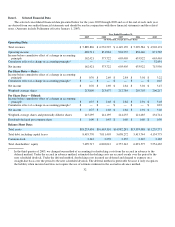

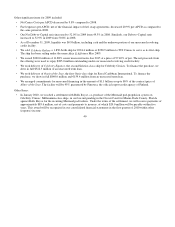

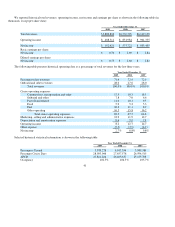

The selected consolidated financial data presented below for the years 2005 through 2009 and as of the end of each such year,

are derived from our audited financial statements and should be read in conjunction with those financial statements and the related

notes. (Amounts include Pullmantur effective January 1, 2007).

32

Item 6. Selected Financial Data

Year Ended December 31,

2009 2008 2007 2006 2005

(in thousands, exce

p

t

p

er share data)

O

p

eratin

g

Data:

Total revenues

$ 5,889,826

$ 6,532,525

$ 6,149,139

$ 5,229,584

$ 4,903,174

Operating income

488,511

831,984

901,335

858,446

871,565

Income before cumulative effect of a change in accounting

principle

162,421

573,722

603,405

633,922

663,465

Cumulative effect of a change in accounting principle

—

—

—

—

52,491

Net income

162,421

573,722

603,405

633,922

715,956

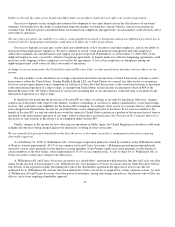

Per Share Data

—

Basic:

Income before cumulative effect of a change in accounting

principle

$0.76

$2.69

$2.84

$3.01

$3.22

Cumulative effect of a change in accounting principle

$

—

$

—

$

—

$

—

$0.25

Net income

$0.76

$2.69

$2.84

$3.01

$3.47

Weighte

d

-average shares

213,809

213,477

212,784

210,703

206,217

Per Share Data

—

Diluted:

Income before cumulative effect of a change in accounting

principle

$0.75

$2.68

$2.82

$2.94

$3.03

Cumulative effect of a change in accounting principle

$—

$—

$—

$—

$0.22

Net income

$0.75

$2.68

$2.82

$2.94

$3.26

Weighte

d

-average shares and potentially dilutive shares

215,295

214,195

214,255

221,485

234,714

Dividends declared per common share

$0.00

$0.45

$0.60

$0.60

$0.56

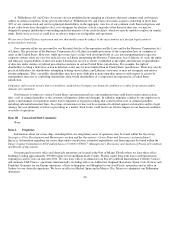

Balance Sheet Data:

Total assets

$18,233,494

$16,463,310

$14,982,281

$13,393,088

$11,255,771

Total debt, including capital leases

8,419,770

7,011,403

5,698,272

5,413,744

4,154,775

Common stock

2,243

2,239

2,235

2,225

2,165

Total shareholders’ equity

7,499,717

6,803,012

6,757,343

6,091,575

5,554,465

In the third quarter of 2005, we changed our method of accounting for drydocking costs from the accrual in advance to the

deferral method. Under the accrual in advance method, estimated drydocking costs are accrued evenly over the period to the

next scheduled drydock. Under the deferral method, drydocking costs incurred are deferred and charged to expense on a

straight-line basis over the period to the next scheduled drydock. The deferral method is preferable because it only recognizes

the liability when incurred and does not require the use of estimates inherent in the accrual in advance method.

1

1

1

1