Royal Caribbean Cruise Lines 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Brian J. Rice has served as Executive Vice President and Chief Financial Officer since November 2006. Mr. Rice has been

employed with Royal Caribbean since 1989 in a variety of positions including Executive Vice President, Revenue Performance. In

such capacity, Mr. Rice was responsible for revenue management, air/sea, groups, international operations, decision support,

reservations and customer service for both Royal Caribbean International and Celebrity Cruises. As part of his responsibilities,

Mr. Rice oversees revenue performance.

Harri U. Kulovaara has served as Executive Vice President, Maritime, since January 2005. Mr. Kulovaara is responsible for fleet

design and newbuild operations. Mr. Kulovaara also chairs our Maritime Safety Advisory Board. Mr. Kulovaara has been employed

with Royal Caribbean since 1995 in a variety of positions, including Senior Vice President, Marine Operations, and Senior Vice

President, Quality Assurance. Mr. Kulovaara is a naval architect and engineer.

The risk factors set forth below and elsewhere in this Annual Report on Form 10-K are important factors, among others, that

could cause actual results to differ from expected or historical results. It is not possible to predict or identify all such factors.

Consequently, this list should not be considered a complete statement of all potential risks or uncertainties. (See Item 7.

M

anagemen

t

’s Discussion and Analysis of Financial Condition and Results of Operations for a cautionary note regarding forward-

looking statements.)

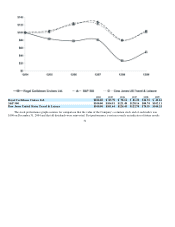

The adverse impact of the current worldwide economic environment on the demand for cruises could adversely impact our operating

results, cash flows and financial condition.

The demand for cruises is affected by international, national and local economic and business conditions. The current worldwide

economic environment, including high unemployment rates, the volatility in the price of fuel and declines in the securities, real estate

and other markets, has had an adverse effect on vacationers’ discretionary income and consumer confidence. This, in turn, has

resulted in cruise booking slowdowns, decreased cruise prices and lower onboard revenues for us and for the others in the cruise

industry. While we have recently begun to discern improvements in the current economic environment, we cannot predict the extent

or strength of these improvements. If the current environment worsens, we could experience a prolonged period of booking

slowdowns, depressed cruise prices and reduced onboard revenues. This could adversely impact our operating results, cash flows and

financial condition including the impairment of the value of our ships, goodwill and other intangible assets.

We may not be able to obtain sufficient financing or capital for our needs or may not be able to do so on terms that are acceptable or

consistent with our expectations.

To fund our capital expenditures and scheduled debt payments, we have historically relied on a combination of cash flows

provided by operations, drawdowns under available credit facilities, the incurrence of additional indebtedness and the sale of equity or

debt securities in private or public securities markets. The decrease in consumer cruise spending as a result of the current economic

environment is adversely impacting our cash flows from operations. The disruption of the credit markets in 2008 and 2009 resulted in

a lack of liquidity worldwide. A recurrence of these events may affect our ability to successfully raise capital or to do so on

acceptable terms. These factors may prevent us from having sufficient available capital or financing to meet our needs or to do so on

acceptable terms. In addition, our senior debt credit rating is currently BB- with a negative outlook by Standard and Poor’s and Ba3

with a negative outlook by Moody’s and our corporate credit rating is Ba2 with a negative outlook by Moody’s. There is no assurance

that our credit ratings will not be lowered further. The lowering of our credit ratings may increase our cost of financing and can make

it more difficult for us to access the financial markets. We will be required to secure Allure of the Seas if at the time we draw down on

our loan to purchase the vessel our senior debt is rated below BB- by Standard & Poor’s or below Ba3 by Moody’s. See Item 7.

M

anagemen

t

’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.

21

Item 1A. Risk Factors