Royal Caribbean Cruise Lines 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

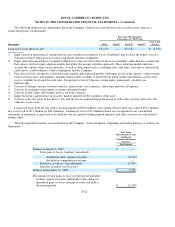

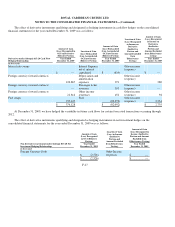

The effect of derivatives not designated as hedging instruments on the consolidated financial statements for the year ended

December 31, 2009 was as follows:

Credit Related Contingent Features

Starting in 2012, our current interest rate and cross currency derivative instruments may require us to post collateral if our

Standard & Poor’s and Moody’s credit ratings are below specified levels. Specifically, if on the fifth anniversary of entering into a

derivative transaction and on all succeeding fifth-year anniversaries our credit ratings for our senior debt were to be below BBB- by

Standard & Poor’s and Baa3 by Moody’s, then each counterparty to such derivatives with whom we are in a net liability position that

exceeds the applicable minimum call amount may demand that we post collateral in an amount equal to the net liability position. The

amount of collateral required to be posted following such event will change each time our net liability position increases or decreases

by more than the applicable minimum call amount. If our credit rating for our senior debt is subsequently equal to or above BBB- by

Standard & Poor’s or Baa3 by Moody’s, then any collateral posted at such time will be released to us and we will no longer be

required to post collateral unless we meet the collateral requirement at the next 5th year anniversary. Currently, our senior debt credit

rating is BB- with a negative outlook by Standard & Poor’s and Ba3 with a negative outlook by Moody’s. Only our interest rate and

cross currency derivative instruments have a term of at least five years and will not reach their fifth anniversary until 2012. Therefore,

as of December 31, 2009, we are not required to post any collateral for our derivative instruments.

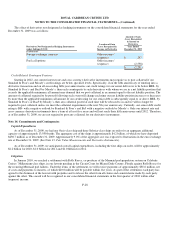

Note 14. Commitments and Contingencies

Capital Expenditures

As of December 31, 2009, we had one Oasis-class ship and three Solstice-class ships on order for an aggregate additional

capacity of approximately 13,950 berths. The aggregate cost of the ships is approximately $4.2 billion, of which we have deposited

$430.7 million as of December 31, 2009. Approximately 9.0% of the aggregate cost was exposed to fluctuations in the euro exchange

rate at December 31, 2009. (See Note 13. Fair Value Measurements and Derivative Instruments).

As of December 31, 2009, we anticipated overall capital expenditures, including the four ships on order, will be approximately

$2.2 billion for 2010, $1.0 billion for 2011 and $1.0 billion for 2012.

Litigation

In January 2010, we reached a settlement with Rolls Royce, co-producer of the Mermaid pod-propulsion system on Celebrity

Cruises’ Millennium-class ships, in our lawsuit pending in the Circuit Court for Miami-Dade County, Florida against Rolls Royce for

the recurring Mermaid pod failures. Under the terms of the settlement, we will receive payments of approximately $85.6 million, net

of costs and payments to insurers, of which $20.0 million will be payable within five years. As part of the settlement, each party has

agreed to the dismissal of the lawsuit with prejudice and to release the other from all claims and counterclaims made by each party

against the other. This award will be recognized in our consolidated financial statements in the first quarter of 2010 within other

(expense) income.

F-28

Derivatives Not Designated as Hedging Instruments

under Subto

p

ic 815-20

Location of Gain

(Loss) Recognized in

Income on Derivative

Amount of Gain

(Loss) Recognized

in Income on

Derivative

Year Ended

December 31

,

2009

I

n thousands

Foreign exchange contracts

Other income /

(expense)

$247

Fuel call options

Other income /

(expense)

(2,538)

$(2,291)