Royal Caribbean Cruise Lines 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

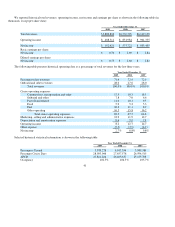

Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

Revenues

Total revenues for 2009 decreased $642.7 million or 9.8% to $5.9 billion from $6.5 billion in 2008. This decrease is primarily

due to higher discounts on our ticket prices, and to a lesser extent a decrease in onboard spending and the adverse effect of foreign

currency as a result of a stronger United States dollar against the euro, British pound and Canadian dollar compared to 2008. Our

revenues were also adversely impacted by a decrease in occupancy from 104.5% in 2008 compared to 102.5% in 2009. The decrease

in occupancy was driven by the current worldwide economic environment with disproportionate pressure within the Spanish market.

In addition, the adverse impact of the H1N1 virus resulted in selective itinerary modifications and diminished demand for our cruises

to Mexico and the Caribbean. This revenue decrease was partially offset by an estimated increase of approximately $335.0 million

attributable to an increase in capacity of 5.1%. Although the number of passengers carried in 2009 decreased as compared to 2008, on

average, passengers sailed more days per voyage in 2009 as compared to 2008 due to certain itinerary changes. The increase in

capacity is primarily due to a full year of Celebrity Solstice, which entered service in November 2008, a full year of Independence of

the Seas, which entered service in May 2008, the addition of Celebrity Equinox, which entered service in July 2009, the addition of

Pacific Dream, which entered service in May 2009 as part of the termination of the charter to Island Cruises, a full year of Ocean

D

ream, which entered service in March 2008 and the addition of Oasis of the Seas, which entered service in December 2009. This

increase in capacity was partially offset by the sale of Celebrity Galaxy to TUI Cruises in March 2009, the sale of Oceanic in April

2009 and the Atlantic Star which is no longer in operation.

Onboard and other revenues included concession revenues of $215.6 million in 2009 compared to $230.8 million for the same

period in 2008. The decrease in concession revenues was primarily due to a decrease in spending on a per passenger basis, partially

offset by the increase in capacity mentioned above.

Cruise Operating Expenses

Total cruise operating expenses for 2009 decreased $332.6 million or 7.6% to $4.1 billion from $4.4 billion for 2008. This

decrease was primarily due to a decrease in commissions as a result of discounted ticket prices, a decrease in air expense due to a

reduction in guests booking air service through us, a decrease in transportation and lodging expenses related to certain itinerary

changes, and the impact of the stronger United States dollar against the euro, British pound and Canadian dollar compared to 2008. In

addition, fuel expenses, which are net of the financial impact of fuel swap agreements, decreased 17.9% per metric ton in 2009 as

compared to 2008 primarily as a result of lower fuel prices. To a lesser extent, the decrease was also related to a decrease in tour and

air expenses. These decreases were partially offset by the increase in capacity mentioned above.

Marketing, Selling and Administrative Expenses

Marketing, selling and administrative expenses for 2009 decreased $14.5 million or 1.9% to $762.0 million from $776.5 million

for 2008. The decrease is mainly due to the impact of our cost-containment initiatives and to termination benefits of $9.0 million

incurred during 2008 that did not recur in 2009. The decrease was partially offset by an increase in marketing and selling expenses

associated with our international expansion.

Depreciation and Amortization expenses

Depreciation and amortization expenses for 2009 increased $47.8 million or 9.2% to $568.2 million from $520.4 million for

2008. The increase is primarily due to a full year of Celebrity Solstice, which entered service in November 2008, a full year of

I

ndependence of the Seas, which entered service in May 2008 and the addition of Celebrity Equinox which entered service in July

2009. To a lesser extent, the increase is also due to depreciation associated with shipboard and shore-side additions. These increases

were partially offset by the sale of Celebrity Galaxy to TUI Cruises.

Other Income (Expense)

Interest expense, net of interest capitalized, decreased to $300.0 million in 2009 from $327.3 million in 2008. Gross interest

expense decreased to $341.1 million in 2009 from $371.7 million in 2008. The decrease was primarily due to lower interest rates,

partially offset by a higher average debt level. Interest capitalized decreased to $41.1 million in 2009 from $44.4 million in 2008

primarily due to lower interest rates.

44