Royal Caribbean Cruise Lines 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

characterization of the lease is ultimately determined to be incorrect, we could be required to indemnify the lessor under certain

circumstances. The lessor has advised us that they believe their characterization of the lease is correct. Based on the foregoing and our

review of available information, we do not believe an indemnification is probable. However, if the lessor loses its dispute and we are

required to indemnify the lessor, we cannot at this time predict the impact that such an occurrence would have on our financial

condition and results of operations.

Some of the contracts that we enter into include indemnification provisions that obligate us to make payments to the

counterparty if certain events occur. These contingencies generally relate to changes in taxes, increased lender capital costs and other

similar costs. The indemnification clauses are often standard contractual terms and are entered into in the normal course of business.

There are no stated or notional amounts included in the indemnification clauses and we are not able to estimate the maximum

potential amount of future payments, if any, under these indemnification clauses. We have not been required to make any payments

under such indemnification clauses in the past and, under current circumstances, we do not believe an indemnification obligation is

probable.

Other than the items described above, we are not party to any other off-balance sheet arrangements, including guarantee

contracts, retained or contingent interest, certain derivative instruments and variable interest entities, that either have, or are

reasonably likely to have, a current or future material effect on our financial position.

Funding Sources

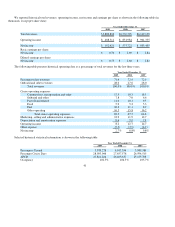

We have significant contractual obligations of which the capital expenditures associated with our ship purchases and our debt

maturities represent our largest funding needs. We have $3.2 billion in contractual obligations due in 2010 of which approximately

$2.0 billion relates to the acquisition of the Celebrity Eclipse and Allure of the Seas along with progress payments on other ship

purchases. In addition, we have $11.3 billion in contractual obligations due beyond 2010 of which debt maturities and ship purchase

obligations represent $7.6 billion and $1.5 billion, respectively. We have historically relied on a combination of cash flows provided

by operations, drawdowns under our available credit facilities and the incurrence of additional debt to fund these obligations.

As of December 31, 2009, our liquidity was $0.9 billion consisting of approximately $284.6 million in cash and cash equivalents

and $575.0 million available under our unsecured revolving credit facility. In addition, we had a working capital deficit of $1.7 billion

as of December 31, 2009 comparable with our working capital deficit of $1.7 billion as of December 31, 2008. Similar to others in

our industry, we are able to operate with a substantial working capital deficit because (1) passenger receipts are primarily paid in

advance with a relatively low-level of accounts receivable, (2) rapid turnover results in a limited investment in inventories and

(3) voyage-related accounts payable usually become due after receipt of cash from related bookings. In addition, we finance the

purchase of our ships through long-term debt instruments of which the current portion of these instruments increases our working

capital deficit. The current portion of long-term debt increased from $471.9 million as of December 31, 2008 to $756.2 million as of

December 31, 2009. We generate substantial cash flows from operations and our business model, along with our unsecured revolving

credit facility, has historically allowed us to maintain this working capital deficit and still meet our operating, investing and financing

needs. We expect that we will continue to have working capital deficits in the future.

We have three Solstice-class vessels and one Oasis-class vessel under construction in Germany and Finland, respectively, all of

which have committed bank financing arrangements which include financing guarantees.

We anticipate that our cash flows from operations, our current available credit facilities, and these financing arrangements will

be adequate to meet our capital expenditures and debt repayments in the foreseeable future.

The decrease in consumer cruise spending as a result of the current economic environment has adversely impacted our cash

flows from operations. The disruption of the credit markets in 2008 and 2009 resulted in a lack of liquidity worldwide. Although we

have witnessed an improvement in the credit markets and operating environment towards the end of 2009 and early 2010, a

recurrence of these events may affect our ability to successfully raise capital or to do so on acceptable terms. In addition, our senior

debt credit rating is currently BB- with a negative outlook by Standard and Poor’s and Ba3 with a negative outlook by Moody’s (our

corporate credit rating is Ba2 with a negative outlook). The cumulative impact to interest expense in 2009 as a result of credit ratings

downgrades which occurred during 2009 was not material to our results of operations. There is no assurance that our credit ratings

will not be lowered further.

49