Royal Caribbean Cruise Lines 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

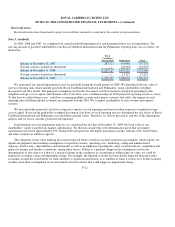

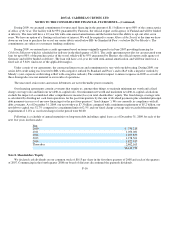

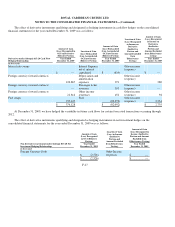

Note 10. Earnings Per Share

A reconciliation between basic and diluted earnings per share is as follows (in thousands, except per share data):

Diluted earnings per share did not include options to purchase 5.0 million, 5.3 million and 2.8 million shares for each of the

years ended December 31, 2009, 2008 and 2007, respectively, because the effect of including them would have been antidilutive.

Note 11. Retirement Plan

We maintain a defined contribution pension plan covering full-time shoreside employees who have completed the minimum

period of continuous service. Annual contributions to the plan are based on fixed percentages of participants’ salaries and years of

service, not to exceed certain maximums. Pension expenses were $13.6 million, $17.3 million and $15.1 million for the years ended

December 31, 2009, 2008 and 2007, respectively.

Note 12. Income Taxes

We and the majority of our subsidiaries are currently exempt from United States corporate tax on United States source income

from the international operation of ships pursuant to Section 883 of the Internal Revenue Code. Regulations under Section 883 have

limited the activities that are considered the international operation of a ship or incidental thereto. Accordingly, our provision for

United States federal and state income taxes includes taxes on certain activities not considered incidental to the international operation

of our ships.

Additionally, some of our ship-operating subsidiaries are subject to income tax under the tonnage tax regimes of Malta or the

United Kingdom. Under these regimes, income from qualifying activities is not subject to corporate income tax. Instead, these

subsidiaries are subject to a tonnage tax computed by reference to the tonnage of the ship or ships registered under the relevant

provisions of the tax regimes. Income from activities not considered qualifying activities, which we do not consider significant,

remains subject to Maltese or United Kingdom corporate income tax.

Income tax expense for items not qualifying under Section 883 or under tonnage tax regimes, and for the remainder of our

subsidiaries was not significant for the years ended December 31, 2009, 2008 and 2007.

We do not expect to incur income taxes on future distributions of undistributed earnings of foreign subsidiaries. Consequently,

no deferred income taxes have been provided for the distribution of these earnings.

F-19

Year Ended December 31,

2009 2008 2007

Net income for basic and diluted earnings per share

$162,421

$573,722

$603,405

Weighte

d

-average common shares outstanding

213,809

213,477

212,784

Dilutive effect of stock options and restricted stock awards

1,486

718

1,471

Diluted weighted-average shares outstanding

215,295

214,195

214,255

Basic earnings per share:

Net income

$0.76

$2.69

$2.84

Diluted earnings per share:

Net income

$0.75

$2.68

$2.82