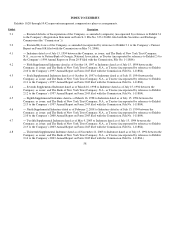

Royal Caribbean Cruise Lines 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

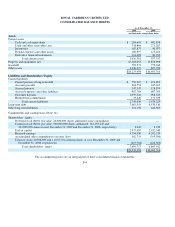

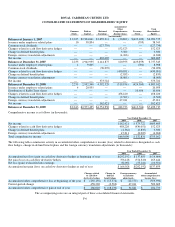

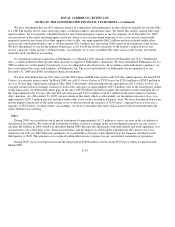

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

The accompanying notes are an integral part of these consolidated financial statements.

F-5

Year Ended December 31,

2009 2008 2007

(in thousands)

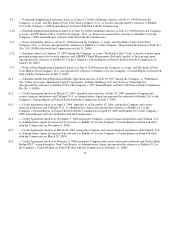

O

p

eratin

g

Activities

Net income

$ 162,421

$ 573,722

$ 603,405

Adjustments:

Depreciation and amortization

568,214 520,353

483,066

Changes in operating assets and liabilities:

(Increase) decrease in trade and other receivables, net

(3,633)

28,150

(122,682)

Increase in inventories

(11,295)

(140)

(19,424)

(Increase) decrease in prepaid expenses and other assets

(3,085)

12,884

(37,650)

Increase in accounts payable

16,424

22,322

23,398

Increase (decrease) in accrued interest

18,668

(3,571)

78,160

Increase in accrued expenses and other liabilities

15,391 39,766

72,035

Increase (decrease) in customer deposits

32,038

(118,541)

184,713

Other, ne

t

49,738

(3,690)

3,673

Net cash provided by operating activities

844,881

1,071,255

1,268,694

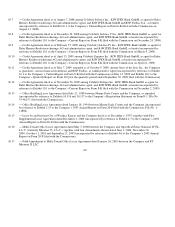

Investin

g

Activities

Purchases of property and equipment

(2,477,549)

(2,223,534)

(1,317,381)

Repayment of notes from TUI Travel

—

—

100,000

Cash received on settlement of derivative financial instruments

110,830

269,815

59,392

Loans and equity contributions to unconsolidated affiliates

(181,683)

(52,323)

—

Proceeds from sale of Celebrit

y

Galax

y

290,928

—

—

Proceeds from sale of investment in Island Cruises

—

51,400

—

Other, ne

t

(16,983)

(22,607)

(12,569)

Net cash used in investing activities

(2,274,457)

(1,977,249)

(1,170,558)

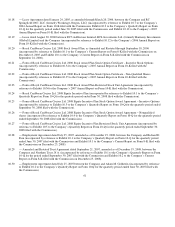

Financin

g

Activities

Proceeds from issuance of deb

t

2,317,158

2,223,402

1,934,979

Debt issuance costs

(61,157)

(23,872)

(10,146)

Repayments of debt

(948,467)

(987,547)

(1,805,798)

Dividends paid

—

(128,045)

(98,298)

Proceeds from exercise of common stock options

569

3,817

19,632

Other, ne

t

4,103

(4,369)

(3,758)

Net cash provided by financing activities

1,312,206

1,083,386

36,611

Effect of exchange rate changes on cash

(889)

(5,298)

(8,483)

Net (decrease) increase in cash and cash equivalents

(118,259)

172,094

126,264

Cash and cash equivalents at beginning of year

402,878

230,784

104,520

Cash and cash equivalents at end of year

$284,619

$402,878

$230,784

Su

pp

lemental Disclosures

Cash paid during the year for:

Interest, net of amount capitalized

$ 288,458

$ 321,206

$ 285,206

Non-cash Investin

g

Transactions

We accrued for purchases of property and equipment paid in 2009

$—

$ 63,857

$—