Royal Caribbean Cruise Lines 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

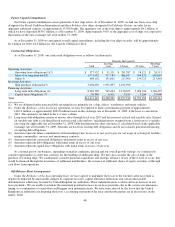

We are focused on ensuring adequate cash and liquidity. We are continually committed to improving our cost focus and have

implemented cost-containment initiatives including the renegotiation of long-term contracts with our vendors and a detailed emphasis

on cost control. To ensure adequate liquidity, we have discontinued our quarterly dividend commencing in the fourth quarter of 2008,

we have tactically evaluated our non-shipbuild capital expenditures and will consider further newbuild orders as market conditions

warrant; however, if a newbuild order were to be placed in the near term, a new delivery would not arrive before 2013. We anticipate

that our cash flows from operations, our current available credit facilities and our current financing arrangements will be adequate to

meet our capital expenditures and debt repayments over the next twelve-month period. In addition, we may elect to fund our

contractual obligations through other means if current conditions in the capital markets improve.

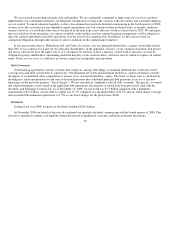

If any person other than A. Wilhelmsen AS. and Cruise Associates, our two principal shareholders, acquires ownership of more

than 30% of our common stock and our two principal shareholders, in the aggregate, own less of our common stock than such person

and do not collectively have the right to elect, or to designate for election, at least a majority of the board of directors, we may be

obligated to prepay indebtedness outstanding under the majority of our credit facilities, which we may be unable to replace on similar

terms. If this were to occur, it could have an adverse impact on our liquidity and operations.

Debt Covenants

Our financing agreements contain covenants that require us, among other things, to maintain minimum net worth and a fixed

coverage ratio and limit our net debt-to-capital ratio. Our minimum net worth and maximum net debt-to-capital calculations exclude

the impact of accumulated other comprehensive income (loss) on total shareholders’ equity. The fixed coverage ratio is calculated by

dividing net cash from operations by the sum of dividend payments plus scheduled principal debt payments in excess of any new

financings for the past four quarters (“fixed charges”). We are currently in compliance with all debt covenants. The specific covenants

and related definitions can be found in the applicable debt agreements, the majority of which have been previously filed with the

Securities and Exchange Commission. As of December 31, 2009, our net worth was $7.3 billion compared with a minimum

requirement of $5.2 billion, our net-debt-to-capital was 52.7% compared to a maximum limit of 62.5% and our fixed charge coverage

ratio exceeded the minimum requirement of 1.25x as our fixed charges for the period were $0.00.

Dividends

During fiscal year 2008, we paid out dividends totaling $128.0 million.

In November 2008 our board of directors discontinued our quarterly dividend commencing with the fourth quarter of 2008. This

decision is intended to enhance our liquidity during this period of heightened economic and financial market uncertainty.

50