Royal Caribbean Cruise Lines 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

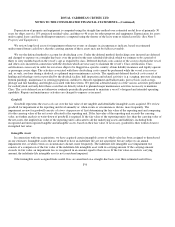

We have determined that our 40% minority interest in a ship repair and maintenance facility which we initially invested in 2001,

is a VIE. The facility serves cruise and cargo ships, oil and gas tankers, and offshore units. We utilize this facility, among other ship

repair facilities, for our regularly scheduled drydocks and certain emergency repairs as may be required. As of December 31, 2009,

our investment in this entity including equity and loans, which is also our maximum exposure to loss as we are not contractually

required to provide any financial or other support to the facility, was approximately $66.2 million and was included within other

assets in our consolidated balance sheets. Of this amount, $26.1 million was invested in 2008 as part of an expansion of the facility.

We have determined we are not the primary beneficiary as we would not absorb a majority of the facility’s expected losses nor

receive a majority of the facility’s residual returns. Accordingly, we do not consolidate this entity and account for this investment

under the equity method of accounting.

In conjunction with our acquisition of Pullmantur, we obtained a 49% minority interest in Pullmantur Air, S.A. (“Pullmantur

Air”), a small air business that operates three aircrafts in support of Pullmantur’s operations. We have determined Pullmantur Air is a

VIE for which we are the primary beneficiary as we are obligated to absorb its losses. In accordance with authoritative guidance, we

have consolidated the assets and liabilities of Pullmantur Air. The assets and liabilities of Pullmantur Air are immaterial to our

December 31, 2009 and 2008 consolidated financial statements.

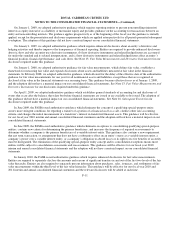

We have determined that our 50% interest in the TUI Cruises GmbH joint venture with TUI AG, which operates the brand TUI

Cruises, is a variable interest entity. In March 2009, we sold Celebrity Galaxy to TUI Cruises for €€224.4 million or $290.9 million to

serve as its first ship, which began sailing in May 2009. Concurrently with entering into the agreement to sell Celebrity Galaxy, we

executed certain forward exchange contracts to lock in the sales price at approximately $315.0 million. Due to the related party nature

of this transaction, we deferred the entire gain on the sale of $35.9 million and will recognize this amount over the remaining life of

the ship estimated to be 23 years. We and TUI AG each invested €€112.2 million or $145.5 million in the joint venture to fund the

ship’s purchase. As of December 31, 2009, our investment in this entity which is substantially our maximum exposure to loss, was

approximately $203.5 million and was included within other assets in the consolidated balance sheet. We have determined that we are

not the primary beneficiary of this joint venture as we would not absorb the majority of TUI Cruises’ expected losses nor receive a

majority of TUI Cruises’ residual returns. Accordingly, we do not consolidate this entity and account for this investment under the

equity method of accounting.

Other

During 2009, we recorded an out of period adjustment of approximately $12.3 million to correct an error in the calculation of

our deferred tax liability. We reduced the deferred tax liability to reflect a change in the enacted Spanish statutory tax rate used to

calculate the liability in 2006 which was identified during 2009. Because the adjustment, both individually and in the aggregate, was

not material to any of the prior years’ financial statements, and the impact of correcting the adjustment in the current year is not

material to the full year 2009 financial statements, we recorded the correction of this adjustment in the financial statements in the

third quarter of 2009. This amount was recognized within other income (expense) in our consolidated statements of operations.

During 2007, we received proceeds from the repayment of $100.0 million of notes from TUI Travel, which we purchased in

March 2006.

F-14