Royal Caribbean Cruise Lines 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Outlook

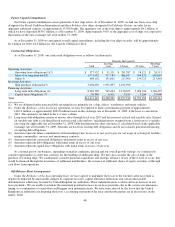

On January 28, 2010, we announced the following guidance for the full year and first quarter of 2010:

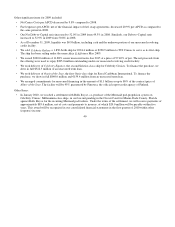

Full Year 2010

We expected Net Yields to increase in the range of 3% to 6% compared to 2009.

We expected Net Cruise Costs per APCD and Net Cruise Costs per APCD, excluding fuel, to be from flat to up slightly

compared to 2009.

We do not forecast fuel prices and our cost calculation for fuel is based on current “at-the-pump” prices net of any hedging

impacts. If fuel prices for the full year 2010 remain at the level of January 28, 2010, fuel expenses for the full year 2010 would be

approximately $687.0 million. For the full year 2010, our fuel expense is approximately 50% hedged and a 10% change in fuel prices

would result in a change in our fuel expenses of approximately $34.0 million for the full year 2010, after taking into account existing

hedges.

We expected a 11.4% increase in capacity in 2010, primarily driven by a full year of Oasis of the Seas, which entered service in

December 2009, a full year of Celebrity Equinox, which entered service in July 2009, a full year of Pacific Dream, which entered

service in May 2009, the addition of Celebrity Eclipse, which will enter service during the second quarter of 2010, and the addition of

A

llure of the Seas, which will enter service in the fourth quarter of 2010.

Depreciation and amortization expenses were expected to be in the range of $640.0 million to $660.0 million, and interest

expense was expected to be in the range of $330.0 million to $350.0 million.

Based on the expectations contained in this Outlook section, and assuming that fuel prices remain at the level of the January 28,

2010 “at-the-pump” prices, we expected full year 2010 earnings per share to be in the range of $2.00 to $2.20.

Our outlook has remained essentially unchanged since our announcement on January 28, 2010.

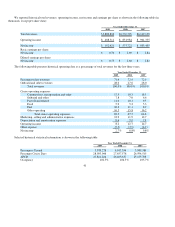

First Quarter 2010

As announced on January 28, 2010, we expected Net Yields to increase approximately 2% compared to 2009.

We expected Net Cruise Costs per APCD to be approximately flat compared to 2009. Excluding fuel, we expected Net Cruise

Costs per APCD to increase approximately 1% compared to 2009.

We do not forecast fuel prices and our cost calculation for fuel is based on current “at-the-pump” prices net of any hedging

impacts. If fuel prices for the first quarter of 2010 remain at the level of January 28, 2010, fuel expenses for the first quarter of 2010

would be approximately $163.0 million. For the first quarter of 2010, our fuel expense is approximately 58% hedged and a 10%

change in fuel prices would result in a change in our fuel expenses of approximately $7.0 million for the first quarter of 2010, after

taking into account existing hedges.

We expected a 9.2% increase in capacity, primarily driven by the addition of Oasis of the Seas, which entered service in

December 2009, the addition of Celebrity Equinox, which entered service in July 2009 and the addition of Pacific Dream, which

entered service in May 2009.

Depreciation and amortization expenses were expected to be in the range of $155.0 million to $160.0 million and interest

expense was expected to be in the range of $82.0 million to $87.0 million.

Based on the expectations contained in this Outlook section, and assuming that fuel prices remain at the level of the January 28,

2010 “at-the-pump” prices, we expected a first quarter 2010 earnings per share in the range of $0.25 to $0.30.

Our outlook has remained essentially unchanged since our announcement on January 28, 2010.

43