Royal Caribbean Cruise Lines 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

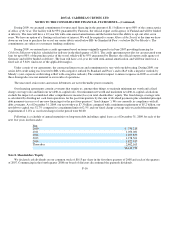

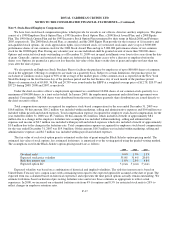

The reported fair values are based on a variety of factors and assumptions. Accordingly, the fair values may not represent actual

values of the financial instruments and long-lived assets that could have been realized as of December 31, 2009 or December 31,

2008, or that will be realized in the future and do not include expenses that could be incurred in an actual sale or settlement.

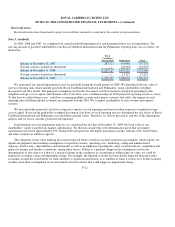

Concentrations of Credit Risk

We monitor concentrations of credit risk associated with financial and other institutions with which we conduct significant

business. Our exposure under foreign currency contracts, fuel call options, interest rate and fuel swap agreements that are in-the-

money are limited to the cost of replacing the contracts in the event of non-performance by the counterparties to the contracts, all of

which are currently our lending banks. To minimize this risk, we select counterparties with credit risks acceptable to us and we limit

our exposure to an individual counterparty. Credit risk, including but not limited to counterparty nonperformance under derivative

instruments, our revolving credit facility and new ship progress payment guarantees, is not considered significant, as we primarily

conduct business with large, well-established financial institutions and insurance companies with which we have long-term

relationships and have credit risks acceptable to us or the credit risk is spread out among a large number of counterparties. We do not

anticipate nonperformance by any of our significant counterparties. In addition, we have established guidelines regarding credit

ratings and instrument maturities that we follow to maintain safety and liquidity. We do not normally require collateral or other

security to support credit relationships; however, in certain circumstances this option is available to us. We normally require

guarantees to support new ship progress payments to shipyards.

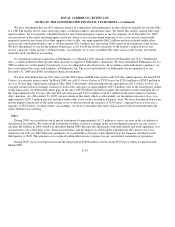

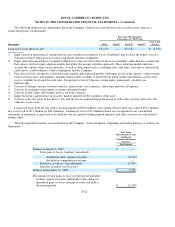

Derivative Instruments

We are exposed to market risk attributable to changes in interest rates, foreign currency exchange rates and fuel prices. We

manage these risks through a combination of our normal operating and financing activities and through the use of derivative financial

instruments pursuant to our hedging practices and policies. The financial impact of these hedging instruments is primarily offset by

corresponding changes in the underlying exposures being hedged. We achieve this by closely matching the amount, term and

conditions of the derivative instrument with the underlying risk being hedged. We do not hold or issue derivative financial

instruments for trading or other speculative purposes. We monitor our derivative positions using techniques including market

valuations and sensitivity analyses.

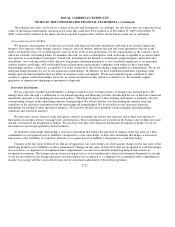

We enter into various forward, swap and option contracts to manage our interest rate exposure and to limit our exposure to

fluctuations in foreign currency exchange rates and fuel prices. These instruments are recorded on the balance sheet at their fair value

and the vast majority are designated as hedges. We also have non-derivative financial instruments designated as hedges of our net

investment in our foreign operations and investments.

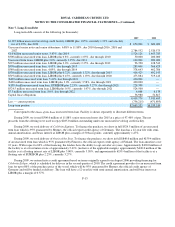

At inception of the hedge relationship, a derivative instrument that hedges the exposure to changes in the fair value of a firm

commitment or a recognized asset or liability is designated as a fair value hedge. A derivative instrument that hedges a forecasted

transaction or the variability of cash flows related to a recognized asset or liability is designated as a cash flow hedge.

Changes in the fair value of derivatives that are designated as fair value hedges are offset against changes in the fair value of the

underlying hedged assets, liabilities or firm commitments. Changes in fair value of derivatives that are designated as cash flow hedges

are recorded as a component of accumulated other comprehensive income (loss) until the underlying hedged transactions are

recognized in earnings. The foreign-currency transaction gain or loss of our nonderivative financial instrument designated as a hedge

of our net investment in our foreign operations and investments are recognized as a component of accumulated other comprehensive

income (loss) along with the associated foreign currency translation adjustment of the foreign operation.

F-22