Pottery Barn 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note K: Related Party Transactions

On January 25, 2010, the independent members of our Board of Directors (the “Board”) approved our entry into

a Retirement and Consulting Agreement (the “Agreement”) with W. Howard Lester (“Mr. Lester”), our former

Chairman of the Board and Chief Executive Officer. Pursuant to the terms of the Agreement, Mr. Lester retired

as Chairman of the Board and Chief Executive Officer on May 26, 2010. The total expense recorded in fiscal

2010 associated with Mr. Lester’s retirement and consulting services, consisting primarily of stock-based

compensation expense, was approximately $5,935,000. As a result of Mr. Lester’s death in November 2010, the

Agreement terminated.

On May 16, 2008, we entered into an aircraft lease agreement with a limited liability company (the “LLC”)

owned by Mr. Lester for use of a Bombardier Global 5000 aircraft, through May 2011. During fiscal 2011 and

fiscal 2010, we paid a total of $1,319,000 and $4,500,000 to the LLC, respectively.

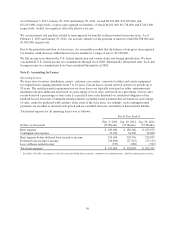

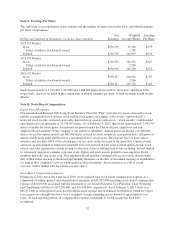

Note L: Stock Repurchase Programs and Dividends

In January 2012, our Board of Directors authorized a stock repurchase program to purchase up to $225,000,000

of our common stock. During fiscal 2012, we repurchased 3,962,034 shares of our common stock at an average

cost of $39.14 per share and a total cost of approximately $155,080,000. In addition, in March 2013, we

announced that our Board of Directors had authorized a new stock repurchase program to purchase up to

$750,000,000 of our common stock, which we intend to execute over the next three years.

Stock repurchases under these programs may be made through open market and privately negotiated transactions

at times and in such amounts as management deems appropriate. The timing and actual number of shares

repurchased will depend on a variety of factors including price, corporate and regulatory requirements, capital

availability and other market conditions. These stock repurchase programs do not have an expiration date and

may be limited or terminated at any time without prior notice.

During fiscal 2011, we repurchased 5,384,036 shares of our common stock at an average cost of $36.11 per share

and a total cost of approximately $194,429,000. During fiscal 2010, we repurchased 4,263,463 shares of our

common stock at an average cost of $29.32 per share and a total cost of approximately $125,000,000.

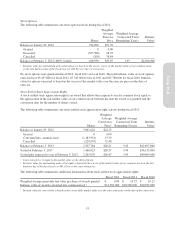

Dividends

In March 2013, we announced that our Board of Directors had authorized a 41% increase in our quarterly cash

dividend, from $0.22 to $0.31 per common share, subject to capital availability. Total cash dividends declared

were approximately $88,452,000, or $0.88 per common share, $76,308,000, or $0.73 per common share, and

$62,574,000, or $0.58 per common share, in fiscal 2012, fiscal 2011 and fiscal 2010, respectively. Our quarterly

cash dividend may be limited or terminated at any time.

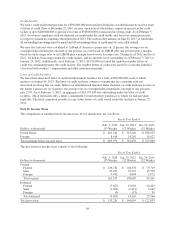

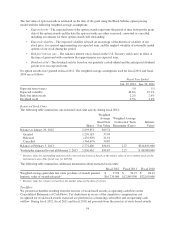

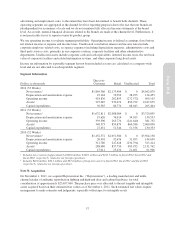

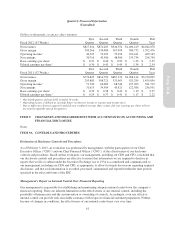

Note M: Segment Reporting

We have two reportable segments, direct-to-customer and retail. The direct-to-customer segment has seven

merchandising concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, PBteen, West Elm, Rejuvenation

and Mark and Graham) which sell our products through our seven e-commerce websites and eight direct-mail

catalogs. Our direct-to-customer merchandising concepts are operating segments, which have been aggregated

into one reportable segment, direct-to-customer. The retail segment has five merchandising concepts (Williams-

Sonoma, Pottery Barn, Pottery Barn Kids, West Elm and Rejuvenation) which sell our products through our retail

stores. Our retail merchandising concepts are operating segments, which have been aggregated into one

reportable segment, retail. Management’s expectation is that the overall economic characteristics of each of our

operating segments will be similar over time based on management’s judgment that the operating segments have

had similar historical economic characteristics and are expected to have similar long-term financial performance

in the future.

These reportable segments are strategic business units that offer similar home-centered products. They are

managed separately because the business units utilize two distinct distribution and marketing strategies. Based on

management’s best estimate, our operating segments include allocations of certain expenses, including

56