Pottery Barn 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

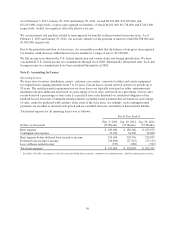

in which entities present comprehensive income in their financial statements. The new guidance removes the

presentation options in previous guidance and requires entities to report components of comprehensive income in

either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. The

new guidance does not change the items that must be reported in other comprehensive income. We adopted ASU

2011-05 in the first quarter of fiscal 2012 and have included two separate but consecutive statements for all

periods presented.

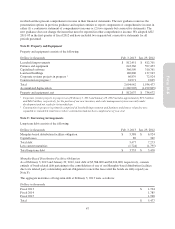

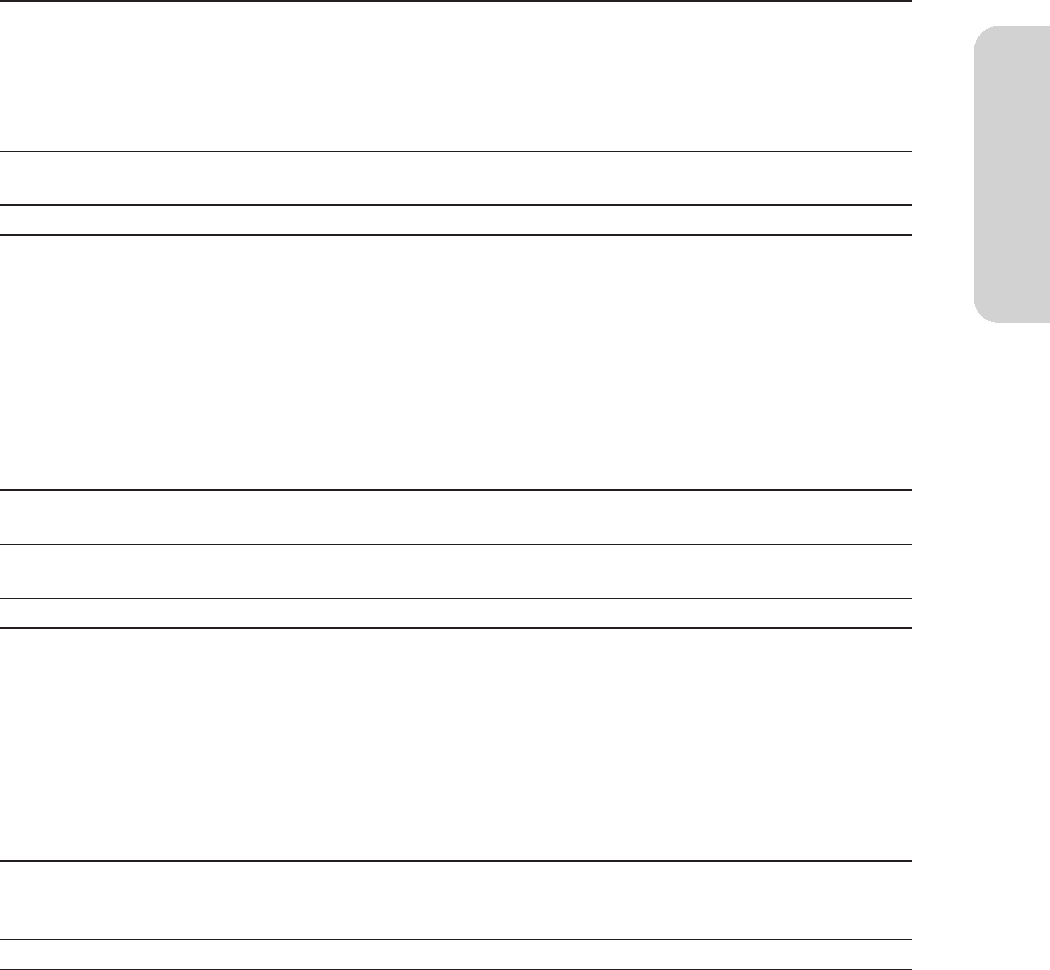

Note B: Property and Equipment

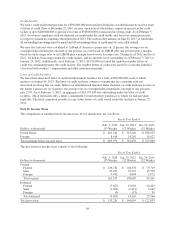

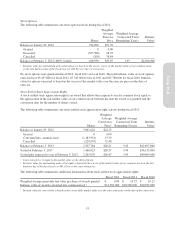

Property and equipment consists of the following:

Dollars in thousands Feb. 3, 2013 Jan. 29, 2012

Leasehold improvements $ 812,451 $ 812,701

Fixtures and equipment 643,366 597,453

Capitalized software 366,509 310,761

Land and buildings 180,806 137,943

Corporate systems projects in progress 166,839 72,924

Construction in progress 224,971 2,695

Total 2,094,942 1,934,477

Accumulated depreciation (1,282,905) (1,199,805)

Property and equipment, net $ 812,037 $ 734,672

1Corporate systems projects in progress as of February 3, 2013 and January 29, 2012 includes approximately $39.7 million

and $48.2 million, respectively, for the portion of our new inventory and order management system currently under

development and not ready for its intended use.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

expanded or remodeled retail stores where construction had not been completed as of year-end.

Note C: Borrowing Arrangements

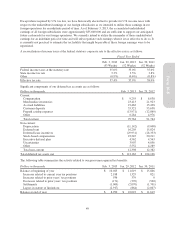

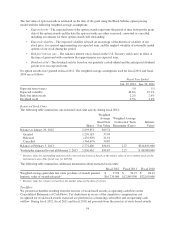

Long-term debt consists of the following:

Dollars in thousands Feb. 3, 2013 Jan. 29, 2012

Memphis-based distribution facilities obligation $ 5,388 $ 6,924

Capital leases 89 349

Total debt 5,477 7,273

Less current maturities (1,724) (1,795)

Total long-term debt $ 3,753 $ 5,478

Memphis-Based Distribution Facilities Obligation

As of February 3, 2013 and January 29, 2012, total debt of $5,388,000 and $6,924,000, respectively, consists

entirely of bond-related debt pertaining to the consolidation of one of our Memphis-based distribution facilities

due to its related party relationship and our obligation to renew the lease until the bonds are fully repaid (see

Note F).

The aggregate maturities of long-term debt at February 3, 2013 were as follows:

Dollars in thousands

Fiscal 2013 $ 1,724

Fiscal 2014 1,785

Fiscal 2015 1,968

Total $ 5,477

47

Form 10-K