Pottery Barn 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

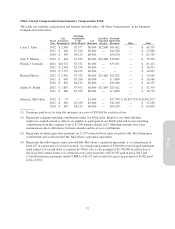

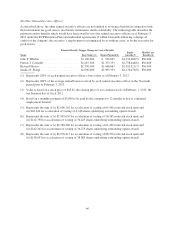

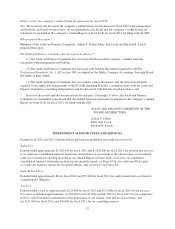

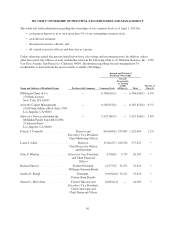

All Other Named Executive Officers

As described above, the other named executive officers are not entitled to severance benefits in connection with

their termination for good reason, involuntary termination, death or disability. The following table describes the

payments and/or benefits which would have been owed by us to the named executive officers as of February 3,

2013 under the EVP Retention Plan (and individual agreements) if within 18 months following a change of

control of the company, the executive’s employment was terminated by us without cause, or by the executive for

good reason.

Potential Double-Trigger Change in Control Benefits

Name Base Salary(1) Bonus Payment(2)

Equity

Awards(3)

Health Care

Benefits(4)

Julie P. Whalen .......................... $1,100,000 $ 526,667 $2,933,060(5) $36,000

Patrick J. Connolly ....................... $1,287,500 $1,333,333 $2,758,446(6) $36,000

Richard Harvey .......................... $1,350,000 $1,046,667 $2,910,521(7) $36,000

Sandra N. Stangl ......................... $1,600,000 $1,983,333 $4,136,470(8) $36,000

(1) Represents 200% of each named executive officer’s base salary as of February 3, 2013.

(2) Represents 200% of the average annual bonus received by each named executive officer in the 36-month

period prior to February 3, 2013.

(3) Value is based on a stock price of $45.02, the closing price of our common stock on February 1, 2013, the

last business day of fiscal 2012.

(4) Based on a monthly payment of $3,000 to be paid by the company for 12 months in lieu of continued

employment benefits.

(5) Represents the sum of (i) $2,906,716 for acceleration of vesting of 64,565 restricted stock units and

(ii) $26,344 for acceleration of vesting of 6,348 shares underlying outstanding option awards.

(6) Represents the sum of (i) $2,545,656 for acceleration of vesting of 56,545 restricted stock units and

(ii) $212,790 for acceleration of vesting of 36,423 shares underlying outstanding option awards.

(7) Represents the sum of (i) $2,768,280 for acceleration of vesting of 61,490 restricted stock units and

(ii) $142,241 for acceleration of vesting of 34,275 shares underlying outstanding option awards.

(8) Represents the sum of (i) $3,978,417 for acceleration of vesting of 88,370 restricted stock units and

(ii) $158,053 for acceleration of vesting of 38,085 shares underlying outstanding option awards.

46