Pottery Barn 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

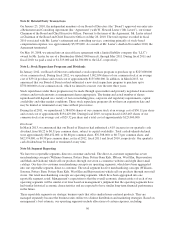

Credit Facility

We have a credit facility that provides for a $300,000,000 unsecured revolving line of credit that may be used for loans

or letters of credit. Prior to December 22, 2016, we may, upon notice to the lenders, request an increase in the credit

facility of up to $200,000,000, to provide for a total of $500,000,000 of unsecured revolving credit. As of February 3,

2013, we were in compliance with our financial covenants under the credit facility and, based on current projections,

we expect to remain in compliance throughout fiscal 2013. The credit facility matures on June 22, 2017, at which time

all outstanding borrowings must be repaid and all outstanding letters of credit must be cash collateralized.

We may elect interest rates calculated at (i) Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent, or a rate based on LIBOR plus one percent) plus a margin

based on our leverage ratio or (ii) LIBOR plus a margin based on our leverage ratio. During fiscal 2012 and fiscal

2011, we had no borrowings under the credit facility, and no amounts were outstanding as of February 3, 2013 or

January 29, 2012. Additionally, as of February 3, 2013, $4,970,000 in issued but undrawn standby letters of

credit was outstanding under the credit facility. The standby letters of credit were issued to secure the liabilities

associated with workers’ compensation and other insurance programs.

Letter of Credit Facilities

We have three unsecured letter of credit reimbursement facilities for a total of $90,000,000, each of which

matures on August 30, 2013. The letter of credit facilities contain covenants that are consistent with our

unsecured revolving line of credit. Interest on unreimbursed amounts under the letter of credit facilities accrues at

the lender’s prime rate (or if greater, the average rate on overnight federal funds plus one-half of one percent)

plus 2.0%. As of February 3, 2013, an aggregate of $18,578,000 was outstanding under the letter of credit

facilities, which represents only a future commitment to fund inventory purchases to which we had not taken

legal title. The latest expiration possible for any future letters of credit issued under the facilities is January 27,

2014.

Note D: Income Taxes

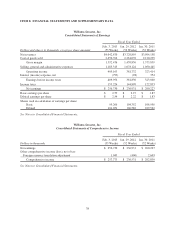

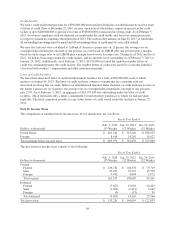

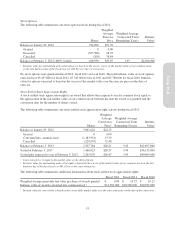

The components of earnings before income taxes, by tax jurisdiction, are as follows:

Fiscal Year Ended

Dollars in thousands

Feb. 3, 2013

(53 Weeks)

Jan. 29, 2012

(52 Weeks)

Jan. 30, 2011

(52 Weeks)

United States $ 401,542 $ 367,620 $ 308,033

Foreign 8,414 14,210 15,027

Total earnings before income taxes $ 409,956 $ 381,830 $ 323,060

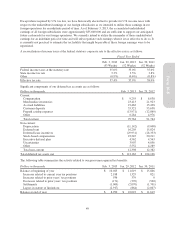

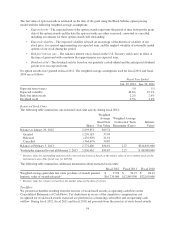

The provision for income taxes consists of the following:

Fiscal Year Ended

Dollars in thousands

Feb. 3, 2013

(53 Weeks)

Jan. 29, 2012

(52 Weeks)

Jan. 30, 2011

(52 Weeks)

Current

Federal $ 136,742 $ 104,370 $ 79,719

State 22,072 22,275 15,576

Foreign 3,441 4,044 3,972

Total current 162,255 130,689 99,267

Deferred

Federal (7,827) 15,650 20,429

State (1,202) (1,427) 3,047

Foreign (0) (13) 90

Total deferred (9,029) 14,210 23,566

Total provision $ 153,226 $ 144,899 $ 122,833

48