Pottery Barn 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.directors, director nominees and principal stockholders, as well as their immediate family members and affiliates,

had, has or will have a direct or indirect material interest, other than transactions available to all of our

employees.

It is our policy to approve related party transactions only when it has been determined that such transaction is in,

or is not inconsistent with, our best interests and those of our stockholders, including situations where we may

obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from

alternative sources or when the transaction is on terms comparable to those that could be obtained in arm’s length

dealings with an unrelated third party.

Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of the estate of

W. Howard Lester (“Mr. Lester”), our former Chairman of the Board and Chief Executive Officer, and the estate

of James A. McMahan (“Mr. McMahan”), a former Director Emeritus and significant stockholder. Partnership 1

does not have operations separate from the leasing of this distribution facility and does not have lease agreements

with any unrelated third parties. The terms of the lease automatically renewed until the bonds that financed the

construction of the facility were fully repaid in December 2010, at which time we continued to rent the facility on

a month-to-month basis. In October 2011, we entered into an agreement with Partnership 1 to lease the facilities

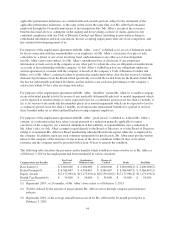

through June 2013. We made annual rental payments in fiscal 2012, 2011 and 2010 of approximately $618,000,

plus interest on the bonds.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of the estate of Mr. Lester, the estate of Mr. McMahan and two

unrelated parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and

does not have lease agreements with any unrelated third parties. The term of the lease automatically renews on an

annual basis until the bonds that financed the construction of the facility are fully repaid in August 2015. As of

February 3, 2013, $5,388,000 was outstanding under the Partnership 2 bonds. We made annual rental payments

of approximately $2,473,000, $2,516,000 and $2,567,000 plus applicable taxes, insurance and maintenance

expenses in fiscal 2012, fiscal 2011 and fiscal 2010, respectively.

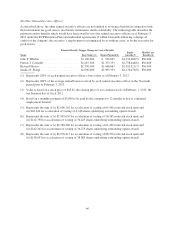

As of February 3, 2013, Partnership 2 qualifies as a variable interest entity and is consolidated by us due to its

related party relationship and our obligation to renew the lease until the bonds are fully repaid. As such, as of

February 3, 2013, our consolidated balance sheet includes $11,535,000 in assets (primarily buildings),

$5,388,000 in debt and $6,147,000 in other long-term liabilities related to the consolidation of the Partnership 2

distribution facility.

Indemnification Agreements

We have indemnification agreements with our directors and executive officers. These agreements, among other

things, require us to indemnify each director and executive officer to the fullest extent permitted by Delaware

law, including coverage of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by

the director or executive officer in any action or proceeding, including any action or proceeding by or in right of

us, arising out of the person’s services as a director or executive officer.

54