Pottery Barn 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EXECUTIVE COMPENSATION

This section provides important information on our executive compensation program for our “named executive

officers,” who in fiscal 2012 were our Chief Executive Officer, our Chief Financial Officer, our three other most

highly compensated executive officers during fiscal 2012, and our former Chief Financial Officer, Sharon L.

McCollam, who retired effective March 6, 2012. Julie Whalen became our Acting Chief Financial Officer

effective March 6, 2012 and our Chief Financial Officer effective July 27, 2012. Richard Harvey resigned as

President of the Williams-Sonoma brand effective March 20, 2013.

Compensation Discussion and Analysis

Executive Summary

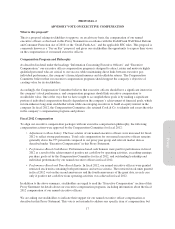

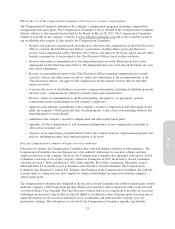

The cornerstone of our executive compensation program is pay for performance. Accordingly, while we pay

competitive base salaries and other benefits, the majority of our named executive officers’ compensation

opportunity is based on incentive pay.

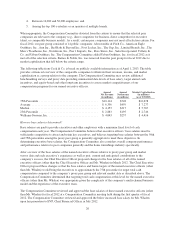

Base Pay

14%

Long-

Term

Incentive

65%

Annual

Incentive

21%

Fiscal 2012 CEO’s Target

Total Direct Compensation

Base Pay

25%

Long-

Term

Incentive

51% Annual

Incentive

24%

Fiscal 2012 Other NEO’s Target

Total Direct Compensation

(Excluding CEO)

Our Compensation Committee, assisted by its independent compensation consultant, Cook & Co., stays informed

of developing executive compensation best practices and strives to implement them. In this regard, our named

executive officer compensation programs include:

• Adopting an annual Say on Pay advisory vote, commencing in 2011 and continuing in this Proxy

Statement, consistent with the direction of 90% of stockholder votes cast in 2011 and consistent with

management’s recommendation to our stockholders;

• Establishing share ownership guidelines for executive officers in 2011;

• Establishing share ownership guidelines for our non-employee directors in 2007;

• Increasing share ownership guidelines for our Chief Executive Officer to five times annual base salary in

2013;

• Providing no golden parachute excise tax gross-up;

• Providing no single-trigger equity compensation vesting on a change of control and instead providing

double-trigger vesting (triggered upon certain terminations of employment following a change of control)

for equity grants made to our named executive officers;

• Prohibiting hedging of company shares by named executive officers and all associates;

21

Proxy