Pottery Barn 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

compensation liability and product and general liability claims reserves based on an actuarial analysis of

historical claims data. Self-insurance reserves for employee health benefits, workers’ compensation and product

and general liability claims were $20,275,000 and $19,103,000 as of February 3, 2013 and January 29, 2012,

respectively, and are recorded within accrued salaries, benefits and other.

Customer Deposits

Customer deposits are primarily comprised of unredeemed gift cards and merchandise credits and deferred

revenue related to undelivered merchandise. We maintain a liability for unredeemed gift cards and merchandise

credits until the earlier of redemption, escheatment or four years as we have concluded that the likelihood of our

gift cards being redeemed beyond four years from the date of issuance is remote.

Deferred Rent and Lease Incentives

For leases that contain fixed escalations of the minimum annual lease payment during the original term of the

lease, we recognize rental expense on a straight-line basis over the lease term, including the construction period,

and record the difference between rent expense and the amount currently payable as deferred rent. We record

rental expense during the construction period. Deferred lease incentives include construction allowances received

from landlords, which are amortized on a straight-line basis over the lease term, including the construction

period.

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents, restricted cash, accounts receivable, accounts payable and debt

approximate their estimated fair values.

Revenue Recognition

We recognize revenues and the related cost of goods sold (including shipping costs) at the time the products are

delivered to our customers. Revenue is recognized for retail sales (excluding home-delivered merchandise) at the

point of sale in the store and for home-delivered merchandise and direct-to-customer sales when the merchandise

is delivered to the customers. Discounts provided to customers are accounted for as a reduction of sales. We

record a reserve for estimated product returns in each reporting period. Shipping and handling fees charged to the

customer are recognized as revenue at the time the products are delivered to the customer. Revenues are

presented net of any taxes collected from customers and remitted to governmental authorities.

Sales Returns Reserve

Our customers may return purchased items for an exchange or refund. We record a reserve for estimated product

returns, net of cost of goods sold, based on historical return trends together with current product sales

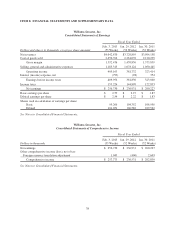

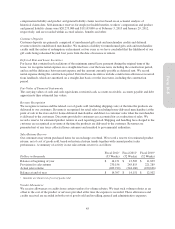

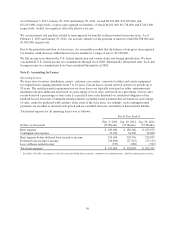

performance. A summary of activity in our sales returns reserve is as follows:

Dollars in thousands

Fiscal 20121

(53 Weeks)

Fiscal 20111

(52 Weeks)

Fiscal 20101

(52 Weeks)

Balance at beginning of year $ 14,151 $ 12,502 $ 11,839

Provision for sales returns 270,156 245,815 221,289

Actual sales returns (269,910) (244,166) (220,626)

Balance at end of year $ 14,397 $ 14,151 $ 12,502

1Amounts are shown net of cost of goods sold.

Vendor Allowances

We receive allowances or credits from certain vendors for volume rebates. We treat such volume rebates as an

offset to the cost of the product or services provided at the time the expense is recorded. These allowances and

credits received are recorded in both cost of goods sold and in selling, general and administrative expenses.

45

Form 10-K