Pottery Barn 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the retail channel, selling, general and administrative expenses as a percentage of net revenues increased

80 basis points during fiscal 2012 compared to fiscal 2011. This increase was primarily driven by higher

employment costs.

Fiscal 2011 vs. Fiscal 2010

Selling, general and administrative expenses increased by $27,679,000, or 2.6%, in fiscal 2011 compared to

fiscal 2010. Including expense of approximately $2,819,000 from asset impairment and early lease termination

charges for underperforming retail stores, selling, general and administrative expenses as a percentage of net

revenues decreased to 29.0% in fiscal 2011 from 30.0% in fiscal 2010 (which included $16,384,000 from asset

impairment and early lease termination charges for underperforming retail stores and $4,319,000 associated with

the retirement of our former Chairman and Chief Executive Officer). This decrease was primarily driven by a

decrease in asset impairment and early lease termination charges related to our underperforming retail stores in

fiscal 2011, lower incentive compensation costs, greater advertising productivity and reductions in other general

expenses. This decrease was partially offset by higher employment which is reflective of our planned incremental

investment to support our e-commerce, global expansion and business development growth strategies.

In the direct-to-customer channel, selling, general and administrative expenses as a percentage of direct-to-

customer net revenues decreased approximately 120 basis points in fiscal 2011 compared to fiscal 2010. This

decrease as a percentage of net revenues was primarily driven by greater advertising productivity and the

leverage of other general expenses due to increasing net revenues, partially offset by higher employment.

In the retail channel, selling, general and administrative expenses as a percentage of retail net revenues decreased

approximately 60 basis points in fiscal 2011 compared to fiscal 2010. This decrease as a percentage of net

revenues was primarily driven by a decrease in asset impairment and early lease termination charges and

reductions in other general expenses, partially offset by higher employment.

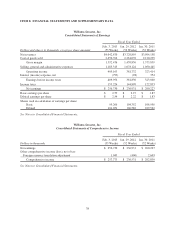

INCOME TAXES

Our effective income tax rate was 37.4% for fiscal 2012, 37.9% for fiscal 2011, and 38.0% for fiscal 2010. The

decrease in the effective income tax rate in fiscal 2012 over fiscal 2011 was primarily driven by certain favorable

income tax resolutions and credits.

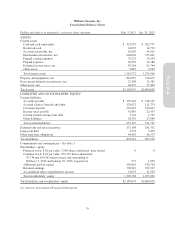

LIQUIDITY AND CAPITAL RESOURCES

As of February 3, 2013, we held $424,555,000 in cash and cash equivalent funds, the majority of which are held

in money market funds and highly liquid U.S. Treasury bills. As is consistent within our industry, our cash

balances are seasonal in nature, with the fourth quarter historically representing a significantly higher level of

cash than other periods.

Throughout the fiscal year, we utilize our cash balances to build our inventory levels in preparation for our fourth

quarter holiday sales. In fiscal 2013, we plan to use our cash resources to fund our inventory and inventory

related purchases, advertising and marketing initiatives, stock repurchases and dividend payments and purchases

of property and equipment. In addition to the current cash balances on hand, we have a credit facility that

provides for a $300,000,000 unsecured revolving line of credit that may be used for loans or letters of credit.

Prior to December 22, 2016, we may, upon notice to the lenders, request an increase in the credit facility of up to

$200,000,000 to provide for a total of $500,000,000 of unsecured revolving credit. During fiscal 2012 and fiscal

2011, we had no borrowings under the credit facility, and no amounts were outstanding as of February 3, 2013 or

January 29, 2012. However, as of February 3, 2013, $4,970,000 in issued but undrawn standby letters of credit

was outstanding under the credit facility. Additionally, as of February 3, 2013, we had three unsecured letter of

credit reimbursement facilities for a total of $90,000,000, of which an aggregate of $18,578,000 was outstanding.

These letter of credit facilities represent only a future commitment to fund inventory purchases to which we had

not taken legal title. We are currently in compliance with all of our financial covenants and, based on our current

projections, we expect to remain in compliance throughout fiscal 2013. We believe our cash on hand, in addition

to our available credit facilities, will provide adequate liquidity for our business operations over the next

12 months.

31

Form 10-K