Pottery Barn 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

performance goal of positive net cash flow provided by operating activities, which resulted in a maximum bonus

payable to the named executive officers under the Bonus Plan in amounts up to $10,000,000, subject to the

Compensation Committee’s negative discretion.

In making its decision regarding bonuses, the Compensation Committee evaluated company performance and the

individual performance of the named executive officers. The Chief Executive Officer made recommendations to

the Compensation Committee based on her subjective assessment of each executive’s performance relative to

their roles and areas of responsibility. In fiscal 2012, achievement of the secondary performance goal of earnings

per share was set at $2.52 per share. Actual performance for fiscal 2012 exceeded this secondary performance

goal. The Compensation Committee discussed the Chief Executive Officer’s recommendations and concurred

that the results for fiscal 2012 were better than expected and the named executive officers performed well, noting

that performance results varied significantly. The Compensation Committee accepted the recommendations of

the Chief Executive Officer and awarded the named executive officers bonuses as described below. The

Compensation Committee, in recognition of Ms. Alber’s individual performance and overall company

performance, awarded her the bonus amount described below.

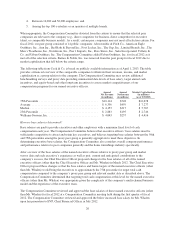

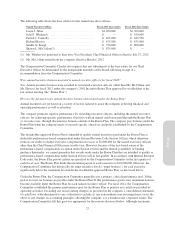

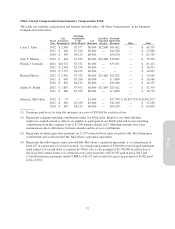

Named Executive Officer

Fiscal 2012

Bonus

Amount

Fiscal 2012

Bonus

(as a Percentage

of Base Salary)

Laura J. Alber ......................... $2,800,000 215%

Julie P. Whalen ........................ $ 750,000 136%

Patrick J. Connolly ..................... $ 700,000 109%

Richard Harvey ........................ — —

Sandra N. Stangl ....................... $1,600,000 200%

Sharon L. McCollam(1) .................. — —

(1) Ms. McCollam did not receive a bonus pursuant to the Bonus Plan due to her retirement in March 2012. Please see below

for a summary of Ms. McCollam’s severance paid pursuant to her separation agreement.

How is long-term incentive compensation determined in general?

The third primary component of the company’s executive compensation program consists of long-term equity

compensation awards. The Compensation Committee continues to believe that equity compensation awards are

important for motivating executive officers and other employees to increase stockholder value over the long

term.

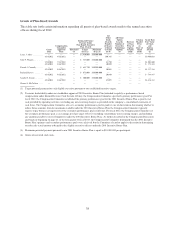

The equity awards granted to named executive officers are designed to deliver target total direct compensation

(base salary, target bonus and equity awards) that is competitive with that offered by comparable companies for

each named executive officer’s job level, e.g., between the 50th and 75th percentile of our company’s proxy peer

group, with the exception of Mr. Connolly. These target levels reflect the Chief Executive Officer and

Compensation Committee’s assessment of such executives’ ongoing contributions to the company, create an

incentive for such executives to remain with the company, and provide a long term incentive for the executives to

help the company achieve its financial and strategic objectives. Mr. Connolly’s target total direct compensation

(base salary, target bonus and long-term incentives) is over the 75th percentile based on the Compensation

Committee’s subjective determination that Mr. Connolly’s extensive marketing experience is critical to the

company.

In the past, the Compensation Committee granted both restricted stock units and stock-settled stock appreciation

rights to its named executive officers. In fiscal 2012, the Compensation Committee decided to grant only

restricted stock units with performance criteria to the named executive officers. The Compensation Committee

believes that restricted stock units are a powerful and substantive retention tool. Further, the Compensation

Committee believes that restricted stock units create incentives for performance and align executive interests

with those of stockholders, as a restricted stock unit’s value increases or decreases with changes in the

company’s stock price.

30