Pottery Barn 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

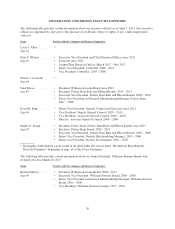

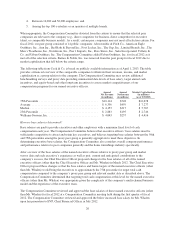

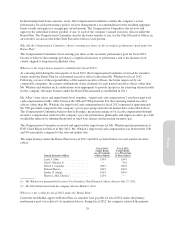

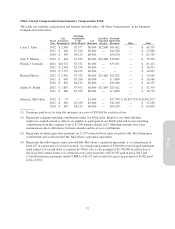

The following table shows the base salaries for the named executive officers.

Named Executive Officer Fiscal 2011 Base Salary Fiscal 2012 Base Salary

Laura J. Alber ................................. $1,200,000 $1,300,000

Julie P. Whalen(1) .............................. $ — $ 550,000

Patrick J. Connolly ............................. $ 625,000 $ 643,750

Richard Harvey ................................ $ 675,000 $ 675,000

Sandra N. Stangl ............................... $ 750,000 $ 800,000

Sharon L. McCollam(2) ......................... $ 875,000 $ —

(1) Ms. Whalen was promoted to Executive Vice President, Chief Financial Officer effective July 27, 2012.

(2) Ms. McCollam retired from the company effective March 6, 2012.

The Compensation Committee Charter also requires that any adjustments to the base salary for our Chief

Executive Officer be determined by the independent members of the Board following receipt of a

recommendation from the Compensation Committee.

Were annual incentive bonuses awarded to named executive officers for fiscal 2012?

Yes. Annual incentive bonuses were awarded to our named executive officers (other than Ms. McCollam and

Mr. Harvey) for fiscal 2012 under the company’s 2001 Incentive Bonus Plan approved by stockholders at the

last annual meeting (the “Bonus Plan”).

How are the parameters for annual incentive bonuses determined under the Bonus Plan?

Annual incentives are set based on a variety of factors tailored to assist the company in driving financial and

operating performance as well as retention.

The company promotes superior performance by rewarding executive officers, including the named executive

officers, for achieving specific performance objectives with an annual cash bonus paid through the Bonus Plan

or, in some cases, through discretionary bonuses outside of the Bonus Plan. The company pays bonuses under the

Bonus Plan when the company meets or exceeds specific objectives and goals established by the Compensation

Committee.

The stockholder-approved Bonus Plan is intended to qualify annual incentives paid under the Bonus Plan as

deductible performance-based compensation under Internal Revenue Code Section 162(m), which otherwise

restricts our ability to deduct executive compensation in excess of $1,000,000 for the named executive officers

other than the Chief Financial Officer per taxable year. However, because of the fact-based nature of the

performance-based compensation exception under Section 162(m) and the limited availability of binding

guidance thereunder, we cannot guarantee that awards made under the Bonus Plan that are intended to qualify as

performance-based compensation under Section 162(m) will in fact qualify. In accordance with Internal Revenue

Code rules, the Bonus Plan payout criteria are specified by the Compensation Committee in the first quarter of

each fiscal year. The Bonus Plan limits the maximum payout to each executive to $10,000,000. However, the

Compensation Committee has historically set target incentive levels (“target bonuses”) for each executive

significantly below the maximum level under the stockholder-approved Bonus Plan, as discussed below.

Under the Bonus Plan, the Compensation Committee generally sets a primary, critical performance goal. If this

goal is not met, no bonuses are payable under the Bonus Plan. If this performance goal is met, maximum bonuses

become available under the Bonus Plan for each named executive officer. For fiscal 2012, the Compensation

Committee established the primary performance goal for the Bonus Plan as positive net cash flow provided by

operating activities (excluding any non-recurring charges) as provided on the company’s consolidated statements

of cash flows, with adjustments to any evaluation to exclude (i) any extraordinary non-recurring items, or (ii) the

effect of any changes in accounting principles affecting the company’s or a business unit’s reported results. The

Compensation Committee felt this goal was appropriate for the reasons discussed below. Although maximum

27

Proxy